Why Long Island Tax Assessment Matters for Your Wallet

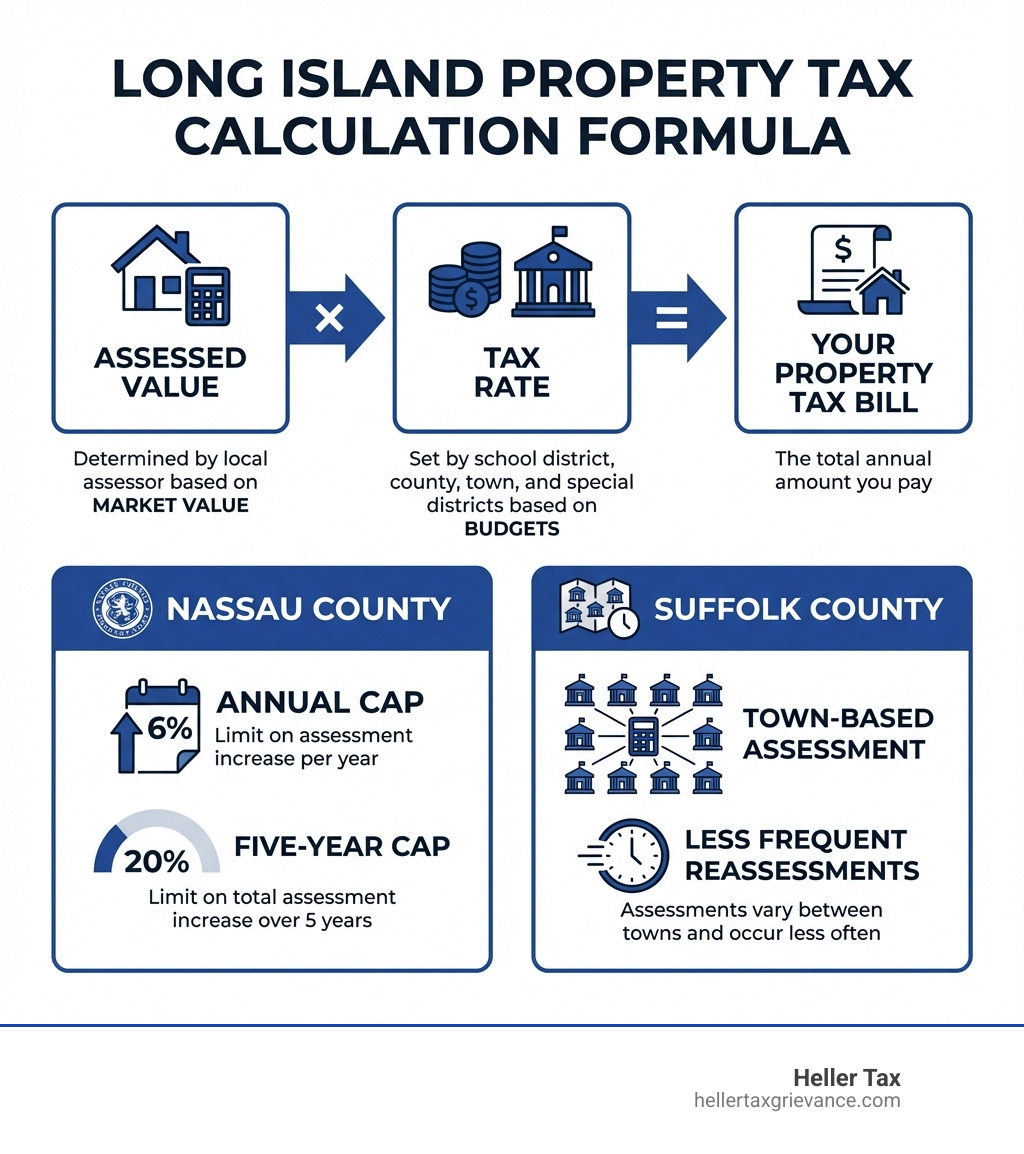

Long Island tax assessment is how Nassau and Suffolk County assessors determine your property’s value for tax purposes. This assessed value, multiplied by your local tax rate, dictates your annual property tax bill—one of the largest expenses for Long Island homeowners.

Quick Answer: What You Need to Know About Long Island Tax Assessment

- Assessment Basis: Your property is assessed based on its market value.

- Two Counties, Different Rules: Nassau County reassesses annually with computer modeling; Suffolk County reassesses less frequently via 10 town assessors.

- Key Filing Deadlines: Nassau County’s deadline is March 2, 2026 (for 2027/28 tax year); Suffolk County’s is May 19, 2026 (for 2026/27 tax year).

- Your Rights: You can challenge an assessment you believe is excessive, unequal, or unlawful.

- Review Levels: Administrative review (ARC/BAR) is first, followed by Small Claims Assessment Review (SCAR) if needed.

- No Risk: If your grievance is denied, your taxes stay the same—there are no penalties for filing.

Understanding your assessment is critical. Nassau County caps Class I residential assessment increases at 6% annually and 20% over five years. In Suffolk County, assessments vary significantly by town, with some areas not seeing reassessments for years.

Your assessment directly impacts your school taxes (the largest part of your bill), county taxes, and local municipal taxes. The formula is simple: Assessed Value × Tax Rate = Tax Bill. Even with a flat assessment, rising tax rates from increased school and municipal budgets can make your bill climb.

I’m Adam Heller. Since 2007, I’ve helped over 50,000 Long Island homeowners steer the tax assessment process, securing the largest single-year reductions in both Nassau County ($73,000) and Suffolk County ($17,000). After selling my real estate firm to focus on tax grievances, I’ve dedicated my career to fighting for fair assessments and lower tax bills.

Understanding the Long Island Tax Assessment Process

Imagine your home as a slice of a very large pie. Your Long Island tax assessment determines the size of your slice, which then dictates how much of the total property tax burden you’ll bear. It’s a fundamental step in calculating your annual property tax bill.

At its core, a property assessment is an estimate of your property’s market value. But what exactly is “property” in this context? In New York State, “real property” is defined as land and any permanent structures attached to it. This includes our lovely homes, office buildings, farms, and even manufactured homes. Personal property, like cars or jewelry, is not subject to property taxes here.

Now, let’s clarify two terms often used interchangeably but with distinct meanings: market value and assessed value.

- Market Value: This is what your property would realistically sell for under normal conditions—a willing buyer and a willing seller, without any unusual pressures.

- Assessed Value: This is the value your local assessor places on your property for tax purposes. In most communities in New York State (with the notable exceptions of NYC and Nassau County), all taxable properties must be assessed at a uniform percentage of market value each year. This percentage is known as the Level of Assessment (LOA). So, if your home’s market value is $500,000 and the LOA is 10%, your assessed value would be $50,000.

This assessed value is then multiplied by your local tax rate to determine your property tax bill. You can learn more about this calculation in detail by visiting the New York State Department of Taxation and Finance’s guide on how property taxes are calculated. Understanding how this assessment relates to your actual tax bill is crucial for every homeowner, and we’ve put together a resource on How Does Property Assessment Relate to Your Property Tax Bill? to help you connect the dots.

The Role of the Local Assessor

The unsung hero (or sometimes villain, depending on your tax bill!) in this process is the local assessor. This dedicated local official is tasked with estimating the value of all real property within their jurisdiction, whether it’s in Nassau or Suffolk County. But their job extends far beyond just crunching numbers.

Assessors are responsible for:

- Estimating Value: Using various valuation methods (which we’ll discuss next) to determine your property’s market value.

- Maintaining Assessment Rolls: Creating and updating the official list of all properties and their assessed values annually. This roll also includes any exemptions you might be entitled to.

- Inspecting New Construction: Visiting properties that have undergone new construction or significant improvements to ensure these changes are reflected in the assessment.

- Administering Exemptions: Processing and tracking property tax exemptions, such as the STAR (School Tax Relief) program, Veterans exemptions, or Senior Citizens exemptions, which can significantly reduce your taxable assessment.

- Analyzing Market Trends: Continuously studying local real estate market trends to ensure assessments remain fair and uniform across neighborhoods.

- Public Disclosure: Making the tentative assessment roll available for public inspection, and later finalizing it after any complaints are addressed.

- Engaging with Taxpayers: Being available to answer questions about assessments and, if necessary, presenting evidence to the Board of Assessment Review (BAR) or preparing evidence for Small Claims Assessment Review (SCAR) hearings.

In short, assessors play a multifaceted and vital role in our property tax system. To dive deeper into their responsibilities, the NYS Department of Taxation and Finance provides a comprehensive guide on The roles of the assessor.

How Assessments are Determined in Nassau and Suffolk

So, how do assessors come up with that magical number? They primarily use three widely accepted valuation methods:

- Market Approach (Sales Comparison): This is probably the most familiar method. Assessors compare your property to similar properties that have recently sold in your area. They adjust for differences like size, age, condition, and amenities. This is often the most reliable method for residential properties.

- Cost Approach: This method estimates the cost to replace your property with a new one, minus any depreciation due to age or wear and tear, plus the value of the land. It’s often used for newer properties or unique structures where comparable sales are scarce.

- Income Approach: Primarily used for income-generating properties like apartment buildings or commercial spaces, this method estimates value based on the potential rental income the property could generate.

Once a market value is estimated, the assessor applies the uniform percentage of market value (LOA) required by New York State law to arrive at the assessed value. This ensures that all properties in a given municipality are assessed consistently. You can find more general information on Assessments from the state.

In Nassau County, the process has a modern twist. For the 2020-21 property tax year reassessment, and continuing since, Nassau County used a sophisticated system called Computer-Assisted Mass Appraisal (CAMA). This isn’t just a fancy name; it’s a powerful tool that uses computer modeling and statistical analysis to value properties uniformly. For residential properties, this involved dividing them into seven different market valuation areas, each with its own mathematical formula based on statistical multiple regressions. Properties were also grouped into approximately 326 neighborhoods to ensure accuracy. This complex methodology helps ensure that properties with similar characteristics are assessed similarly. We’ve explained more about How Property is Assessed Tax Grievance Works if you’re curious about the mechanics.

Finding Your Property’s Assessment Data

Knowledge is power, especially when it comes to your property taxes. The first step to understanding your assessment is to find your property’s data on the official assessment roll.

An assessment roll is the official public record listing every property within a municipality, along with its estimated market value, assessed value, and any exemptions. Most towns and cities in New York State publish a tentative assessment roll on May 1st each year. This is your first chance to review your assessment. If you don’t challenge it by Grievance Day (typically the fourth Tuesday in May), it becomes part of the final assessment roll.

For Nassau County homeowners, you have an excellent resource in the Nassau County Land Record Viewer. This online tool provides access to a wealth of information maintained by the Department of Assessment, including:

- Assessment roll data

- District information

- Tax maps

- Property photographs

- Past taxes and tax rates

- Exemptions with amounts

- Comparable sales data

- Integration with the County’s Geographic Information System (GIS)

While this viewer is incredibly helpful, Nassau County provides this information as a service and explicitly disclaims warranties regarding its accuracy or completeness. However, it’s still your go-to for initial research. You can access it directly via the LandRecord Lookup.

If you’re in Suffolk County, the Suffolk County Real Property Tax Service Agency is your primary resource. While the assessment process itself is handled by the individual towns, this agency provides crucial services and products related to tax maps and land information. You can find their contact information and access various forms on their page: Real Property Tax Service Agency. They also offer a public tax map viewer and order forms for other tax map products.

Nassau vs. Suffolk: Reassessments, Deadlines, and Key Differences

Long Island is a tale of two counties, and when it comes to property tax assessments, their stories diverge significantly. While both aim for fair taxation, their methodologies and timelines are quite different. These differences are critical for homeowners, as they dictate when and how you can challenge your assessment. We dig deeper into these nuances in our article on Property Taxes in Nassau County and Suffolk County.

Nassau County Assessment Deep Dive

Nassau County has adopted a system of annual reassessment. This means your property’s market value is re-evaluated every year, which keeps assessments aligned with current market conditions and prevents large disparities from accumulating.

As we touched on earlier, this annual reassessment leverages a sophisticated CAMA methodology. For the 2020-21 tax year, approximately 386,000 Class I residential properties were reassessed. This process involved:

- Dividing properties into seven market valuation areas, each with its own unique statistical formula.

- Grouping properties into approximately 326 neighborhoods to ensure that comparable homes were assessed using similar criteria.

- Using statistical multiple regressions to analyze sales data from 2013 through 2018, factoring in about 180 different property features and attributes.

A key aspect of Nassau County’s assessment is the Level of Assessment (LOA). For Class I residential properties in the 2020-21 reassessment, the LOA was set at a tiny 0.1%. This means if your estimated market value was $350,000, your assessed value would be $350 ($350,000 * 0.001).

To protect homeowners from sudden, drastic increases, New York Real Property Tax Law Section 1805 places strict assessment increase caps on Class I residential properties in Nassau County. Your assessed value cannot increase by more than 6% from the prior year’s assessment or more than 20% in any five-year period. This provides stability, even with annual reassessments. If you’re struggling with your Nassau County assessment, our dedicated page on Nassau County Tax Grievance offers more targeted guidance. For a deep dive into the technicalities, you can explore Nassau County’s Reassessment Methodology.

Suffolk County Assessment Deep Dive

In contrast, Suffolk County operates under a town-based assessment system. Here, property assessments are handled by the individual assessor’s offices within each of its 10 towns (such as Brookhaven, Islip, and Smithtown).

Because assessments are managed at the town level, the frequency of reassessments can vary significantly. Many towns in Suffolk County undertake less frequent reassessments compared to Nassau’s annual cycle. This can lead to assessments that lag behind current market values, creating potential grievance opportunities if your assessment is too high.

The critical date for Suffolk County homeowners is Grievance Day, the deadline to contest an assessment. While it’s typically the fourth Tuesday in May for most New York jurisdictions, specific dates can vary by town. For more details on the grievance process in Suffolk, check out our guide to Suffolk County Property Tax Grievance. You can also view official assessment rolls for specific towns, like those found on the Assessment Rolls | Smithtown, NY page.

Key Dates and Deadlines for the Upcoming Tax Year

Staying on top of deadlines is paramount to successfully managing your Long Island tax assessment. Missing a deadline means missing your opportunity to challenge an unfair assessment, so mark your calendars!

Here’s a comparison of key dates for Nassau and Suffolk Counties for this upcoming tax years:

| Event | Nassau County (for 2027/28 Tax Year) | Suffolk County (for 2026/27 Tax Year) |

|---|---|---|

| Tentative Assessment Roll Publication | January 2, 2026 | May 1st (most towns, for 2026/27 assessment) |

| Grievance Filing Window | January 2 – March 2, 2026 | Typically May 1st – May 19th (for 2026/27 assessment), specific to each town. May 19, 2026 is the general deadline for the 2026/27 tax year. |

| School Tax Bill Due (1st Half) | October 1 (payable through Nov 10) | January 10 (bills issued Dec) |

| School Tax Bill Due (2nd Half) | April 1 | May 31 |

| General Tax Bill Due | January 2 | January 10 (bills issued Dec) |

Note: These dates are based on the latest available information and are subject to change. Always verify with official county and town sources.

How to Challenge Your Property Tax Assessment

Finding out your property is over-assessed can be frustrating, but the good news is you have the right to challenge it! The process, commonly known as filing a tax grievance, allows you to seek a reduction in your assessed value. The main grounds for filing a grievance are if you believe your assessment is unequal, excessive, or unlawful.

While the grievance process can sometimes feel like a marathon—it can take up to 18 months from beginning to end—the results are always retroactive to the start of the tax year for which you filed. This means any savings you achieve will be applied back to the beginning of that tax year, so it’s well worth the effort! We have a comprehensive guide on Long Island Property Tax Grievance to walk you through it. You can also watch this helpful video about Contesting your property’s assessment.

Step 1: Administrative Review (ARC)

The first stop in challenging your Long Island tax assessment is the administrative review.

In Nassau County, this is handled by the Assessment Review Commission (ARC). The ARC is an independent agency tasked with reviewing applications for correction of assessment. Crucially, the ARC can only keep your tentative assessed value unchanged or lower it; it cannot increase your assessment. You’ll need to file an Application for Correction of Assessment with them. These forms are typically available online after January 2nd, and you can file electronically through the county’s online appeal system called AROW-Assessment Review. For forms and instructions, visit the Assessment Review Commission website. Our page on Tax Grievance Nassau County Grievance Process provides more specific details.

In Suffolk County, the administrative review is conducted by the Board of Assessment Review (BAR) in your specific town (e.g., Brookhaven, Islip, Smithtown). You’ll file a similar application directly with your town’s assessor’s office.

Step 2: Small Claims Assessment Review (SCAR)

If you’re not satisfied with the decision from the ARC (Nassau) or BAR (Suffolk), you have another avenue: Small Claims Assessment Review (SCAR). This is a judicial review process where you can seek further review of your assessment in the Nassau County Clerk’s Office or the appropriate County Clerk’s Office in Suffolk.

SCAR is specifically designed for owners of one, two, or three-family homes used exclusively for residential purposes. It’s an informal hearing process, often conducted by a hearing officer rather than a judge, making it more accessible to homeowners. There is a $30 filing fee for a SCAR petition, which may be reimbursed if your appeal is successful. We cover this in more detail on our page about Appealing Property Tax Bill New York State.

Preparing for Your Long Island Tax Assessment Challenge

To build a strong case for your grievance, preparation is key. You’ll need to gather compelling evidence that supports your claim of an unfair assessment. This often includes:

- Comparable Sales Data: Research recent sales of properties similar to yours in your neighborhood. The NYS Office of Real Property Tax Services (ORPTS) Municipal Data Portal provides access to Sales Web, which includes 10 years of property sales and transfers for all of New York State (excluding NYC). This is an invaluable tool for finding comparable sales. You can access it via the Office of Real Property Tax Services (ORPTS) Municipal Data Portal.

- Photos of Property Condition: Document any issues that negatively impact your home’s value, such as deferred maintenance, outdated features, or structural problems, especially if your assessment doesn’t reflect these.

- Professional Appraisals: An independent appraisal from a certified appraiser can provide strong evidence of your property’s true market value.

- Any other relevant documentation: This could include a recent purchase agreement if you just bought the home, or documentation of damage that has not been repaired.

Here’s a list of essential documents and information you should consider for a tax grievance:

- Your property’s address and tax map number (SBL number: Section, Block, Lot).

- Your current assessed value and estimated market value.

- Recent sales data for 3-5 comparable properties in your neighborhood.

- Photos of your property, especially highlighting any negative conditions or features that might justify a lower assessment.

- A recent appraisal, if available.

- Any permits for recent improvements that might explain an increase in assessment.

The Impact of Assessments on Your Finances

Your Long Island tax assessment isn’t just a number on a piece of paper; it’s a direct determinant of your annual property tax bill, which in turn significantly impacts your household budget. For many of us, property taxes are one of the largest expenses of homeownership, and a substantial portion of that goes towards funding our local schools.

Understanding School Taxes and Your Assessment

School taxes are typically the biggest component of your overall property tax bill. So, how are they calculated? It’s a three-part equation:

- School District Budget: This is the total amount of money the school district needs to operate for the year, approved by local voters.

- Total Assessed Value: This is the sum of all taxable assessed values of properties within that school district.

- Your Individual Assessment: This is your property’s assessed value.

The formula is essentially: District Budget ÷ Total Assessed Value = Tax Rate. Your individual school tax bill is then derived from your assessed value multiplied by this tax rate. We explore this further in How High Are School Property Taxes in Long Island?.

The implications of this formula are significant. Even if your property’s assessment remains stable, your school taxes can still rise if the school district’s budget increases or if the total assessed value of all properties in the district decreases (meaning fewer properties are sharing the tax burden). This is why we often see increases in our tax bills even without a reassessment, as rising school budgets, driven by factors like inflation and increasing operational costs, directly lead to higher tax rates. This phenomenon is something we’ve frequently observed, as discussed in Long Island School Budgets Increase Property Taxes.

Homeowners should also be aware of programs like the STAR (School Tax Relief) program, which offers property tax exemptions for owner-occupied primary residences. These and other exemptions reduce your taxable assessment, lowering your overall tax bill. Understanding these programs is vital for managing your property tax burden. If you’re wondering why your property taxes seem to keep climbing, our article Why Do Property Taxes Go Up? offers some insights.

Resources for Long Island Homeowners

Navigating the complexities of Long Island tax assessment can feel overwhelming, but you don’t have to go it alone. Numerous resources are available to help you understand your assessment, track deadlines, and potentially reduce your tax burden.

Here’s a list of helpful resources for Long Island homeowners:

- Nassau County Department of Assessment: Your primary source for all assessment-related information in Nassau. You can find forms, instructions, and access the Land Record Viewer.

- Suffolk County Real Property Tax Service Agency: Provides tax map products, verification services, and general information for Suffolk County. Town assessors handle individual property assessments.

- New York State Department of Taxation and Finance: Offers general information and guides on property taxes, assessments, and the grievance process across the state. Their “Check your assessment” page is a good starting point: Check your assessment.

- NYS ORPTS Municipal Data Portal: An excellent resource for researching comparable sales data via Sales Web, municipal profiles, and school apportionment rates. You can find it at Office of Real Property Tax Services (ORPTS) Municipal Data Portal.

- Your Local Town Assessor’s Office (Suffolk County): For specific assessment details and grievance forms in Suffolk County, contact your town’s assessor directly (e.g., Brookhaven, Islip, Smithtown).

- Online Property Tax Calculators: Tools like our own Long Island Property Tax Calculator can help you estimate your potential tax savings.

Conclusion: Taking Control of Your Property Taxes

Understanding your Long Island tax assessment is more than just a chore; it’s a fundamental aspect of responsible homeownership. A fair assessment is your right, and being proactive can save you significant money year after year.

We’ve covered the intricate processes in both Nassau and Suffolk Counties, from how assessments are determined using sophisticated models like CAMA to the critical deadlines that govern the grievance process. We’ve also highlighted the direct impact these assessments have on your finances, particularly through school taxes.

The key takeaway? Don’t assume your assessment is always correct. An annual review of your property’s assessed value is a smart financial habit. If you believe your assessment is excessive, unequal, or unlawful, filing a grievance is your pathway to potentially reducing your property tax burden.

While you can steer this process on your own, it often involves complex research, understanding legal jargon, and adhering to strict deadlines. This is where professional consultants, like us at Heller Tax Grievance, can make a world of difference. We specialize in making the tax reduction process easy for Long Island homeowners, ensuring your case is presented effectively.

Our unique selling proposition is our “You Don’t Pay Unless You Save” guarantee. This means we only charge a fee if we successfully reduce your property taxes, typically a percentage of the first year’s savings. With over $160 million saved for our clients and a track record of securing the largest tax reductions in both Nassau and Suffolk counties, we’re committed to fighting for what’s fair.

If you’re considering challenging your assessment, it’s wise to understand What to Look For When Hiring a Long Island Property Tax Grievance Company. Don’t let an unfair assessment drain your wallet. Take control of your property taxes today by starting your Property Tax Grievance with us.