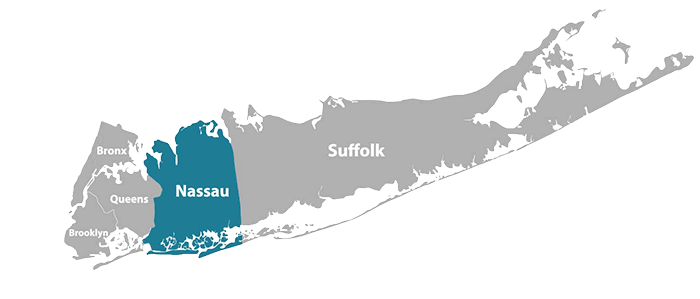

Overview of Property Taxes on Long Island

Long Island, comprising Nassau and Suffolk counties, is well-known for its high property taxes, which rank among the highest in the United States. This article provides an in-depth exploration of Long Island property taxes, detailing the assessment process, tax rates, and the grievance procedure for homeowners looking to reduce their tax burdens.

Property taxes on Long Island are a significant source of revenue for local municipalities, funding essential services such as schools, road maintenance, and public safety. However, these taxes also represent a substantial financial burden for homeowners.

- Assessment Process: Properties on Long Island are assessed based on their market value, which is determined by local assessors. The assessment considers factors such as location, property size, and improvements.

- Tax Rates: Property tax rates in Nassau and Suffolk counties are notably high. The average effective property tax rate in Nassau County is approximately 2.24%, while in Suffolk County it is around 2.37%. These rates are significantly higher than the statewide average of 1.69% and the national average of 1.07%.

Economic Impact of High Property Taxes

The high property taxes on Long Island have several economic implications:

- Home Affordability: Elevated property taxes can make homeownership less affordable, particularly for middle-income and lower-income families. This can lead to demographic shifts as people move to areas with lower tax burdens.

- Market Dynamics: High property taxes can affect the real estate market, influencing property values and sales. Properties with lower tax assessments may be more attractive to buyers, potentially impacting overall market trends.

- Public Services: While high taxes fund essential public services, there is a balance to be maintained. Excessively high taxes can strain homeowners, while insufficient funding can degrade the quality of local services.

The Property Tax Grievance Process

Homeowners on Long Island have the right to challenge their property assessments through a grievance process if they believe their property is over-assessed. Here’s an overview of the grievance procedure:

- Eligibility: Any property owner in Nassau or Suffolk County can file a tax grievance. This includes owners of residential, commercial, and industrial properties.

- Filing Period: The grievance filing periods differ between counties. In Nassau County, grievances can typically be filed from January 2nd to March 1st. In Suffolk County, the filing period usually runs from May 1st to the third Tuesday in May (Heller Tax Grievance).

- Grievance Process: The process involves submitting a formal complaint to the local tax assessor’s office, providing evidence that the property’s assessed value is higher than its market value. Evidence can include recent sales data of comparable properties, professional appraisals, and other relevant documentation.

- Professional Assistance: Homeowners may choose to hire tax grievance companies or attorneys to assist with the process. These professionals often work on a contingency basis, meaning they only get paid if the grievance is successful.

Statistical Insights and Trends

Recent statistics highlight the extent of the property tax burden on Long Island:

- Median Property Tax: In Nassau County, the median property tax is approximately $8,711 per year for a home valued at the median price of $487,900. This translates to an effective tax rate of around 1.79% (Tax-Rates.org).

- Comparative Analysis: Long Island’s property tax rates are among the highest in the nation. For instance, the average property tax rate in Manhattan is just 0.88%, which is significantly lower than the rates in Nassau and Suffolk counties (Heller Tax Grievance).

- Grievance Outcomes: Many homeowners who file grievances successfully reduce their property tax bills. However, the success rate can vary based on the quality of the evidence provided and the specifics of each case.

Long-Term Strategies for Managing Property Taxes

In addition to filing grievances, homeowners can adopt several long-term strategies to manage their property tax burdens:

- Regular Assessments: Periodically review property assessments to ensure they reflect current market conditions. Staying informed about changes in the local real estate market can help identify over-assessments early.

- Tax Exemptions: Explore available tax exemptions, such as those for senior citizens, veterans, and persons with disabilities. These exemptions can provide significant tax relief.

- Home Improvements: Be mindful of how home improvements might affect property assessments and, consequently, tax obligations. While improvements can enhance property value, they can also increase the assessed value.

- Stay Informed: Keep abreast of local tax laws and policies. Changes in legislation or local government policies can impact property taxes and provide opportunities for tax relief.

The Role of Property Tax Revenue in Long Island

Property taxes are the primary source of revenue for local governments on Long Island, playing a crucial role in funding essential services and infrastructure. This section delves into how property tax revenue is utilized and its significance for local communities:

- Education: A substantial portion of property tax revenue is allocated to public schools. This funding supports teacher salaries, school facilities, educational programs, and extracurricular activities. High property taxes often correlate with better-funded schools, which can enhance educational outcomes and property values in the area.

- Public Safety: Property taxes fund police and fire departments, ensuring that communities are safe and well-protected. These services are vital for maintaining public order and responding to emergencies, contributing to the overall quality of life on Long Island.

- Infrastructure Maintenance: Property tax revenue is used for maintaining and improving local infrastructure, including roads, bridges, public parks, and recreational facilities. Well-maintained infrastructure is essential for community development and economic growth.

- Public Services: Other critical public services funded by property taxes include sanitation, public health services, and social services. These services are essential for the well-being of residents, particularly vulnerable populations such as the elderly and low-income families.

Historical Trends in Long Island Property Taxes

Understanding the historical trends in property taxes on Long Island can provide insights into the current tax landscape and future projections. This section explores key trends and factors that have influenced property taxes over the years:

- Property Value Fluctuations: Over the past few decades, Long Island has experienced significant fluctuations in property values. Economic booms and busts, changes in the housing market, and broader economic conditions have all impacted property assessments and, consequently, property tax rates.

- Legislative Changes: Various legislative changes at the state and local levels have influenced property tax policies on Long Island. Notable examples include the implementation of the property tax cap in 2011, which aimed to limit the growth of property taxes and provide relief to homeowners.

- Demographic Shifts: Changes in the demographic composition of Long Island’s population, such as aging residents and shifts in household incomes, have also impacted property tax trends. These demographic shifts influence the demand for public services and the capacity to pay taxes.

- Economic Development: Efforts to promote economic development on Long Island, including initiatives to attract businesses and boost employment, have had mixed impacts on property taxes. While economic growth can expand the tax base, it can also lead to higher property values and increased tax burdens for homeowners.

Challenges in the Property Tax Grievance Process

While filing a property tax grievance can provide significant financial relief, homeowners often face several challenges during the process. This section highlights common obstacles and strategies to overcome them:

- Complex Procedures: The property tax grievance process can be complex and time-consuming, requiring detailed documentation and adherence to strict deadlines. Homeowners must navigate various forms, hearings, and appeals, which can be daunting without professional assistance.

- Access to Accurate Information: Gathering accurate and relevant information to support a grievance can be challenging. Homeowners need access to comparable property sales data, professional appraisals, and other evidence to make a compelling case.

- Lack of Awareness: Many homeowners are unaware of their right to file a grievance or the potential benefits of doing so. Public awareness campaigns and educational resources can help inform residents about the grievance process and encourage participation.

- Limited Success Rates: Not all grievances result in reduced assessments, and success rates can vary depending on the quality of evidence and the specific circumstances of each case. Engaging experienced professionals, such as tax grievance companies or attorneys, can improve the chances of a successful outcome.

Strategies for Effective Property Tax Management

Effective property tax management involves proactive measures to ensure that tax obligations are fair and manageable. This section outlines strategies that homeowners can adopt to manage their property taxes effectively:

- Regular Assessment Reviews: Homeowners should periodically review their property assessments and compare them with current market conditions. Staying informed about changes in property values can help identify potential over-assessments early.

- Utilizing Exemptions and Relief Programs: Exploring available property tax exemptions and relief programs can provide significant savings. For example, exemptions for senior citizens, veterans, and persons with disabilities can reduce tax obligations.

- Home Improvements and Tax Implications: Before making significant home improvements, homeowners should consider how these changes might affect their property assessments and taxes. Consulting with a tax professional can help understand the potential tax implications.

- Professional Assistance: Engaging professional services, such as tax grievance companies, attorneys, or financial advisors, can provide valuable expertise and support throughout the property tax management process. These professionals can offer insights, handle complex procedures, and increase the likelihood of successful tax reductions.

Impact of Property Taxes on Local Economies

The high property taxes on Long Island have profound effects on local economies, influencing both residents and businesses. These taxes, while essential for maintaining public services, can create financial pressures that shape the economic landscape in several ways:

- Housing Market Dynamics: High property taxes can deter potential homebuyers, particularly those looking for affordable housing options. This can lead to slower housing market growth and a potential decline in property values in some areas. As a result, communities may experience lower homeownership rates and increased rental markets.

- Business Environment: Businesses, especially small and medium-sized enterprises, may find it challenging to operate in high-tax areas. Elevated property taxes can increase operational costs, making it harder for businesses to thrive. This can lead to reduced job creation and economic stagnation in certain regions.

- Population Shifts: High property taxes can drive residents to seek more affordable living conditions elsewhere, leading to population declines in high-tax areas. This demographic shift can result in a reduced tax base, further straining local budgets and potentially leading to cuts in public services.

Comparative Analysis with Other Regions

To understand the uniqueness of Long Island’s property tax situation, it’s helpful to compare it with other regions both within and outside New York State:

- New York City: Unlike Long Island, New York City has a relatively lower property tax rate, with an average effective rate of 0.88%. This significant difference can make New York City a more attractive option for some homeowners despite the higher cost of living in other aspects (Heller Tax Grievance).

- National Average: The national average property tax rate is approximately 1.07%, considerably lower than Long Island’s rates. States like Hawaii and Alabama have some of the lowest property tax rates, often below 0.5%, offering stark contrasts to the high taxes on Long Island.

- Northeastern States: Other states in the Northeast, such as New Jersey and Connecticut, also have high property tax rates. However, Long Island’s taxes remain among the highest, reflecting a broader regional trend of elevated property taxes in the Northeast (Heller Tax Grievance).

Legislative Efforts and Reforms

There have been various legislative efforts and reforms aimed at addressing the high property taxes on Long Island. These efforts include:

- Tax Cap Legislation: New York State has implemented a property tax cap that limits the annual growth of property taxes to 2% or the rate of inflation, whichever is lower. This cap aims to curb excessive tax increases and provide predictability for taxpayers.

- Assessment Reforms: Periodic reassessment initiatives have been undertaken to ensure property values are accurately reflected in tax assessments. Nassau County, for instance, has engaged in reassessment projects to correct disparities and ensure fairness in property taxation.

- Tax Relief Programs: Several tax relief programs are available for eligible homeowners, including exemptions for senior citizens, veterans, and disabled individuals. These programs are designed to provide targeted relief to those most affected by high property taxes.

Future Outlook and Recommendations

The future of property taxation on Long Island will likely involve continued efforts to balance the need for revenue with the goal of maintaining affordability for residents. Some recommendations for future action include:

- Enhanced Transparency: Improving the transparency of the assessment process can help homeowners understand how their property values are determined and ensure assessments are fair and accurate.

- Economic Development Initiatives: Encouraging economic development can broaden the tax base and reduce the reliance on property taxes. This can involve attracting new businesses and supporting existing ones to create a more robust local economy.

- Public Engagement: Increasing public engagement in the budgeting and tax assessment processes can help ensure that community needs are met while managing tax burdens. This can involve community forums, surveys, and other methods to gather input from residents.

- Ongoing Legislative Advocacy: Continuous advocacy for legislative reforms at the state level can help address systemic issues in property taxation. This can include pushing for adjustments to the tax cap, reassessment policies, and additional tax relief measures.

Property taxes on Long Island are a significant financial consideration for homeowners, influencing both personal finances and broader economic dynamics. By understanding the assessment process, staying informed about tax rates, and actively engaging in the grievance process when necessary, homeowners can manage their tax burdens more effectively. Long-term strategies, combined with a proactive approach to property assessments and tax grievances, can lead to substantial financial savings and greater peace of mind for Long Island residents.For more detailed information, consider speaking with one of our representatives at Heller Tax Grievance or utilize our online tools