Why Understanding Property Tax Grievances Matters for Long Island Homeowners

A property tax grievance is a formal complaint that challenges the assessed value of your property. If you believe your home or commercial property is assessed too high—meaning the town or county values it higher than it’s actually worth—you have the legal right to dispute that assessment and potentially lower your property tax bill.

Quick Answer:

- What it is: An official process to challenge your property’s assessed value

- Who can file: Property owners, purchasers, or tenants responsible for paying property taxes

- Why file: Your assessment may be too high compared to your property’s actual market value or compared to similar properties

- The result: A successful grievance can reduce your assessment and lower your tax bill, often for multiple years

- The cost: No upfront fees; many professionals work on a contingency basis (you only pay if you save)

Property taxes are often the single largest expense for Long Island homeowners after their mortgage payment. Yet many people simply accept their tax bill each year without question, unaware that the assessed value—the number the town uses to calculate your taxes—can be challenged. In fact, research shows that properties are sometimes assessed at different percentages of their market value, meaning you could be paying significantly more than your fair share.

The grievance process exists specifically to protect homeowners from overpaying. Whether your property is valued higher than comparable homes in your neighborhood, your assessment doesn’t reflect recent market changes, or you were incorrectly denied a tax exemption, filing a grievance gives you a formal way to correct these errors. The process can take up to 18 months, but any reduction you win is retroactive to the beginning of the tax year when you filed.

I’m Adam Heller, and I’ve been helping Long Island property owners steer what is a property tax grievance since 2006, after spending years in real estate where I saw how high property taxes affect home values and affordability. My team at Heller & Consultants Tax Grievance has saved clients over $160 million in the last decade and holds the record reductions in both Nassau County ($73,000 annually) and Suffolk County (over $17,000 annually).

What is a Property Tax Grievance and Who Can File?

At its heart, what is a property tax grievance? It’s your right as a property owner or taxpayer to formally challenge the assessed value that your local government has placed on your property. This assessed value is the basis for calculating your property taxes, so if it’s too high, you’re likely paying more than you should.

The local assessor’s role is to estimate the market value of properties for tax purposes. However, these estimates aren’t always perfect. Market conditions change rapidly, and assessors’ actions can sometimes lag behind these shifts. A property tax grievance allows us to bring current, accurate information to the attention of the taxing jurisdictions to ensure fairness.

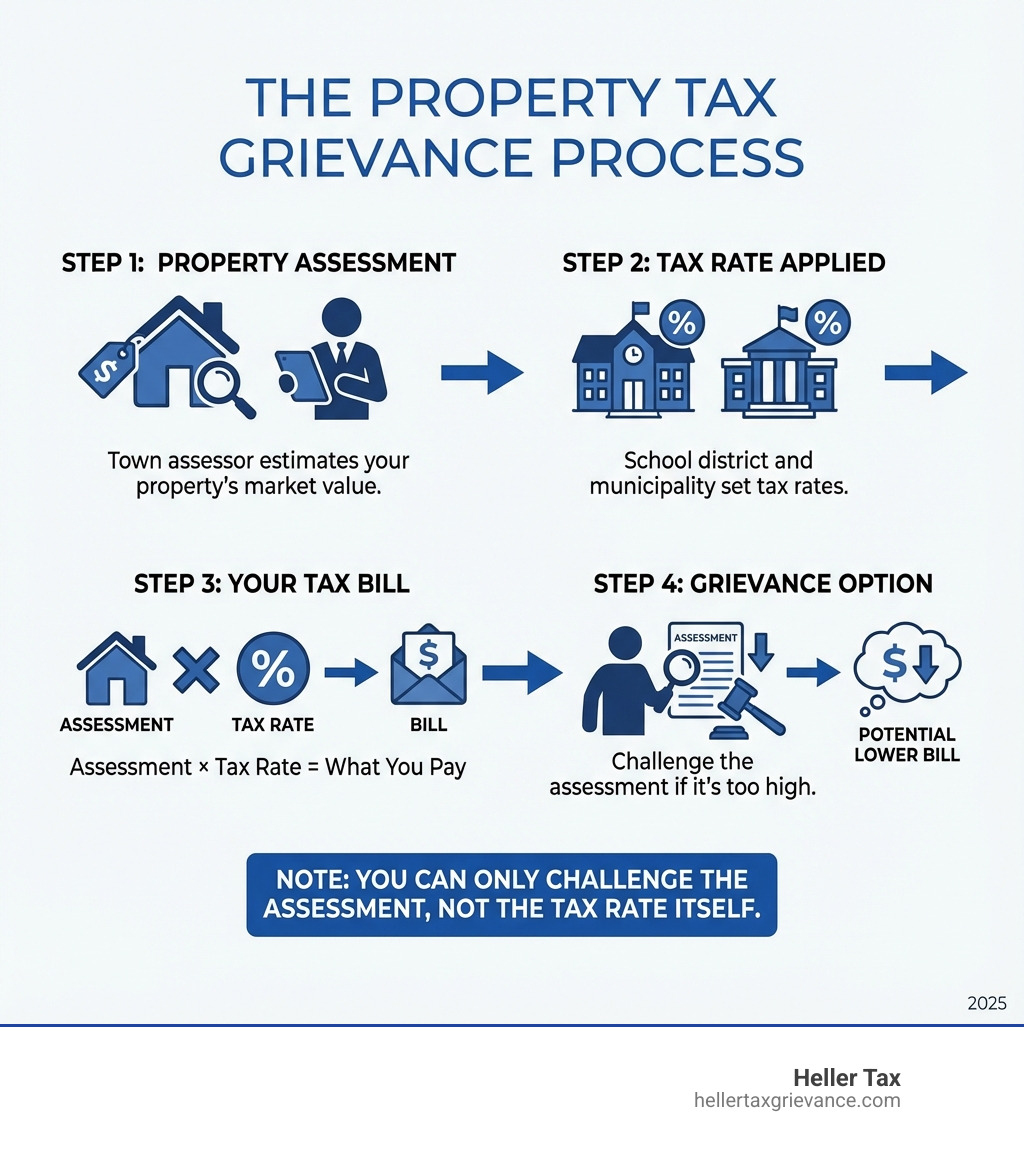

Understanding the difference: Contesting your assessment vs. the tax rate

This is a crucial distinction. When we talk about a property tax grievance, we are contesting the assessment—the value placed on your property by the assessor. We are not contesting the tax rate itself. Tax rates are set by various taxing jurisdictions, such as school districts, county legislatures, towns, and villages, to meet their budgetary needs. These rates can fluctuate annually, and unfortunately, we cannot directly challenge them through a grievance.

Think of it this way: your property tax bill is determined by multiplying your property’s assessed value by the applicable tax rates. If your assessment is fair but you feel your taxes are too high, your concern lies with the taxing jurisdictions that set the rates, not with the assessor. The assessor’s job is solely to determine your property’s value. If we can lower your assessed value, then even with the same tax rate, your overall tax bill will decrease.

To determine if your assessment is too high, you first need to understand the assessor’s estimate of your property’s market value. This information is usually found on your assessment roll. If your municipality assesses at 100% of market value, your assessment and the assessor’s estimated market value will be the same. If not, you can calculate it using a simple formula: assessment ÷ level of assessment = assessor’s estimate of market value. We then compare this to our own estimate of your property’s market value. For tips on how to estimate market value, you can refer to the official guide: How to Estimate the Market Value of Your Home.”

Who is eligible to file a property tax grievance?

The good news is that many people are eligible to file a property tax grievance. If you are responsible for paying property taxes, you generally have the right to file. This includes:

- Property owners: The most common filers, directly challenging the assessment on their owned property.

- Purchasers: If you’ve recently bought a property or are in contract and believe the assessment is too high based on your purchase price.

- Tenants who are required to pay property taxes: If your lease or written agreement stipulates that you are responsible for property taxes, you can file a grievance.

Anyone with a direct financial stake in the property tax bill can initiate a grievance. You don’t necessarily need a lawyer to file, but navigating the complexities can be challenging.

The Four Main Grounds for Filing a Grievance

When you file a property tax grievance, you need a legitimate reason, or “ground,” for your complaint. There are four primary grounds recognized in New York State, each addressing a different type of assessment error.

1. Unequal Assessment

This ground argues that your property is assessed at a higher percentage of its market value than other properties in your community. It’s about fairness and uniformity. Even if your property is assessed at its full market value, if other properties are consistently assessed at a lower percentage (e.g., 80% of market value), then your assessment is unequal.

To prove unequal assessment, we look at:

- Uniform percentage of value: The goal is for all properties to be assessed at a uniform percentage of their market value.

- Level of assessment: This is the ratio of assessed value to market value for properties in a municipality.

- Equalization Rate: Published annually by the state, this rate indicates the percentage of market value at which properties are assessed in a given municipality. For example, if the equalization rate is 58%, a property assessed at $5,800 is theoretically valued at $1,000,000 market value.

- Residential Assessment Ratio (RAR): For one, two, or three-family residential properties, this specific ratio helps demonstrate if residential properties are assessed unequally.

We aim to show that your property’s assessed value, when compared to its market value, is disproportionately higher than the average level of assessment for similar properties in your town or village.

2. Excessive Assessment

This is often the most straightforward ground, arguing that your property’s assessed value is simply too high compared to its actual market value. Excessive assessment can manifest in a few ways:

- Overvaluation: The assessor has estimated your property’s market value to be higher than what it truly is. This is where evidence like recent appraisals, comparable sales data, or a recent “arm’s length sale” of your property (a sale between unrelated parties acting independently) becomes crucial.

- Incorrect partial exemption: You were improperly denied a partial exemption (like STAR, Senior Citizens, or Veterans exemptions), or the exemption amount was miscalculated. For instance, if you qualify for a STAR exemption but it wasn’t applied, your assessment would effectively be “excessive.”

- Transition assessments: In some municipalities, changes from revaluations are phased in over five years through transition assessments. If this calculation is incorrect, it can lead to an excessive assessment.

When claiming excessive assessment due to overvaluation, you must establish your property’s full market value. The official instructions for Form RP-524 provide detailed guidance on this: See the official instructions for Form RP-524.

3. Unlawful Assessment

This ground is less common but very important. It applies when an assessment violates specific legal provisions. Examples include:

- Wholly exempt property: Your property should be entirely exempt from taxation (e.g., a church or a public school), but it has been assessed.

- Assessed by the wrong entity: The property was assessed by an assessor who lacked the authority to do so.

- Property outside district boundaries: Your property is located outside the assessing unit’s boundaries.

- Procedural errors: The assessment was made under an unlawful method, or the property cannot be identified from its description on the assessment roll.

4. Misclassification

This ground applies in municipalities that use a “homestead” and “non-homestead” classification system, which assigns different tax rates to different property types. If your property is placed in the wrong class, leading to a higher tax burden, you can file a grievance for misclassification.

- Homestead properties typically include one, two, or three-family residential homes, residential condominiums, mixed-use parcels that are primarily residential, owner-occupied mobile homes, and certain vacant land or farm properties.

- Non-homestead properties generally encompass commercial, industrial, utility, and special franchise properties.

For instance, if your mixed-use property, which is primarily residential, is entirely classified as non-homestead, you could be paying a higher tax rate than appropriate.

Your Step-by-Step Guide to the Grievance Process

Navigating the property tax grievance process can feel daunting, but breaking it down into manageable steps makes it much clearer. Here’s how we approach it for Long Island homeowners:

Step 1: Review Your Tentative Assessment and Gather Evidence

The first step is always to review your property’s tentative assessment. This is the value that your local assessor has determined for your property before it becomes final. We recommend doing this annually, well before Grievance Day.

If you believe your assessment is too high, an informal meeting with your local assessor can sometimes resolve issues quickly. You can discuss your concerns and present preliminary evidence. However, this is just an informal conversation, and if it doesn’t yield satisfactory results, we proceed to the formal grievance process.

To support your claim, whether informally or formally, you’ll need strong evidence. This typically includes:

- Recent appraisals: A professional appraisal from a licensed appraiser that estimates your property’s market value.

- Comparable sales data: Information on recent sales of similar properties in your neighborhood. We look for “arm’s length sales”—transactions between willing buyers and sellers who are not related and have no undue pressure to buy or sell.

- Condition of property: Any issues with your property’s condition that might negatively impact its value (e.g., structural problems, necessary repairs).

The burden of proof is on you, the property owner, to show that the assessor’s valuation is incorrect. We’re here to help you build that case effectively. You can find your local assessor’s contact information here: Find your local assessor

Step 2: Complete and File the Official Grievance Form

For properties outside New York City and Nassau County, the official form for filing a property tax grievance is Form RP-524, “Complaint on Real Property Assessment.” This multi-part form requires detailed information about your property, your estimated market value, and the specific ground for your complaint (unequal, excessive, unlawful, or misclassification).

Completing this form accurately is critical. You’ll need to provide:

- Property identification: Your parcel number, property address, and other identifying details.

- Stating your case: A clear explanation of why you believe your assessment is incorrect.

- Requested reduction amount: The specific assessment you are seeking. Be careful here, as the amount you request may limit any future reduction.

For residents in Nassau County and New York City, specific forms and procedures apply, and you’ll need to contact their respective assessment review commissions directly. We handle these specific forms and procedures for our Long Island clients.

You can download Form RP-524 here: Download Form RP-524

Step 3: Know the Deadlines for what is property tax grievance

Missing a deadline means forfeiting your right to grieve for that year, and you’ll have to wait until the next cycle. Deadlines vary by location, so confirm the exact date for your specific municipality on Long Island.

Here are the general deadlines for our Long Island clients and surrounding areas:

- Grievance Day: For most towns in New York State, Grievance Day is typically the fourth Tuesday in May. This is the deadline to file Form RP-524 and when the Board of Assessment Review (BAR) generally meets. For 2025, the deadline for most New York property owners to contest their assessment is Tuesday, May 27.

- Nassau County: Complaints must be filed by March 1st. In some years, this date may shift slightly, so always confirm.

- Suffolk County: The deadline to file is the third Tuesday in May.

- New York City: Deadlines are March 15th for Class One properties (primarily residential) and March 1st for all other properties.

- Villages: Villages that assess property often have their BAR meet on the third Tuesday of February, but these dates can vary significantly.

We strongly advise our clients to file their petitions early. This gives us ample time to build a strong case and avoid last-minute rushes.

Navigating the Review Process: From the BAR to the Courts

Once your grievance form is filed, your complaint enters a multi-tiered review process. This begins with an administrative review and can, if necessary, proceed to judicial review.

What is the role of the Board of Assessment Review (BAR)?

The Board of Assessment Review (BAR) is the first formal step in the property tax grievance process. The BAR is an impartial body, typically consisting of three to five appointed members from your community, none of whom can be the assessor or their staff. Their role is to:

- Hear complaints: They meet on Grievance Day (and sometimes other scheduled dates, especially for non-resident owners) to listen to property owners’ complaints.

- Review evidence: They examine the evidence you submit, such as Form RP-524 and any supporting documentation (appraisals, comparable sales).

- Assessor’s attendance: While not part of the BAR, the assessor is required to attend hearings and has the right to present their case and be heard.

- Make a determination: After reviewing all information, the BAR decides whether to grant a reduction, deny the grievance, or make no change.

- Notification of decision: You will be notified of the BAR’s decision, typically by mail.

We often appear before the BAR on behalf of our clients, presenting a compelling case and answering any questions the board may have. However, most times a reduction is denied here, so you must file with NYS Supreme Court.

What happens if your grievance is denied?

If the Board of Assessment Review denies your grievance or does not grant the reduction you requested, don’t despair! This is not the end of the road. You have the right to seek further review through the judicial system.

Upon receiving the BAR’s decision, you will have a limited timeframe to appeal—typically 30 days from the filing of the final assessment roll or the notice of such filing, whichever is later. This is a critical deadline that cannot be missed. Our team carefully tracks these dates to ensure our clients’ rights are protected.

Your next steps for judicial review are usually one of two options: Small Claims Assessment Review (SCAR) or a Tax Certiorari proceeding.

What is Small Claims Assessment Review (SCAR)?

Small Claims Assessment Review (SCAR) is a fantastic, low-cost option designed specifically for homeowners to challenge their assessments without the need for extensive legal proceedings. It’s often referred to as an “informal court” for property tax disputes.

- Eligibility: SCAR is available for owners of one, two, or three-family residential dwellings that are used exclusively for residential purposes, or owners of vacant land that is not large enough for a one, two, or three-family dwelling.

- Cost: There’s a minimal $30 filing fee.

- Process: The hearing is conducted by a Hearing Officer (not a judge) who is typically an attorney with experience in real property law. The only parties present are usually the Hearing Officer, the assessor, and you (or your representative).

- No attorney required: While you can bring an attorney, it’s not legally required, making it more accessible for homeowners.

We frequently represent our clients in SCAR proceedings, leveraging our expertise to present a clear and persuasive case. The goal is to provide reasonable proof to the Hearing Officer for a review of the decision. You can learn more about Small Claims Assessment Review (SCAR) through the New York Courts website: Learn more about Small Claims Assessment Review (SCAR).

For properties that don’t qualify for SCAR (e.g., commercial properties, large residential parcels), the next step is a Tax Certiorari proceeding in the New York State Supreme Court. This is a more formal legal process and almost always requires the assistance of an attorney.

Is Filing a Grievance Worth It? Benefits and Considerations

We understand that the process might seem complex, but the potential benefits of a successful property tax grievance are substantial and often outweigh the effort involved.

What are the potential benefits of a successful grievance?

- Direct tax reduction: The most obvious benefit is a lower property tax bill. This translates into real savings every year. For example, Heller & Consultants Tax Grievance has saved clients over $30 million in the last 10 years, with record reductions in Nassau County of $73,000 a year and over $17,000 a year in Suffolk County.

- Future savings: A reduced assessment can lead to ongoing savings for as long as you own the property, as the new lower assessment generally remains in effect until a significant change (like a major renovation or a new revaluation) occurs.

- Refunds for overpayment: While grievances apply to the current and future tax years, if your assessment is successfully reduced, the savings are retroactive to the beginning of the tax year for which you filed.

- Increased marketability: For those considering selling their home, a lower property tax burden makes your property more attractive to potential buyers. It can literally put more money in their pocket each month, making your home more competitive in the market.

- Correcting the public record: Ensuring your property’s assessment accurately reflects its market value contributes to overall fairness in the tax system.

Will filing a grievance affect my STAR exemption or raise my taxes?

This is a very common concern, and we’re here to put your mind at ease.

- Exemptions are separate: Filing a property tax grievance will not affect your eligibility for property tax exemptions like the STAR program (School Tax Relief), Senior Citizens exemptions, or Veterans Affairs (VA) programs. These exemptions are based on specific criteria (income, age, service status) and are separate from your property’s assessed value.

- It is illegal to raise your taxes in retaliation: New York State law explicitly prohibits assessors from increasing your assessment as a penalty for filing a grievance. Your property taxes will remain unchanged if your grievance is denied. There are no penalties for filing, and you can file again the next year if you choose.

When should you hire a tax grievance professional?

While you can file a property tax grievance on your own, the process can be complex. Here’s why many Long Island homeowners choose to work with professionals like us:

- Complex cases: If your property is unique, or your case involves intricate legal arguments (like misclassification or unlawful assessment), professional expertise is invaluable.

- Lack of time or expertise: Most homeowners are busy and may not have the time, resources, or specialized knowledge to effectively research comparable properties, understand legal jargon, or present a compelling case against experienced town assessors.

- Understanding legal jargon: The laws and procedures governing property tax assessments are very technical. A professional can steer these complexities and use the law to your advantage.

- Presenting evidence effectively: We know what kind of evidence is most persuasive to the Board of Assessment Review and in SCAR proceedings. We gather the necessary documentation and present it in a clear, concise, and impactful manner.

- Navigating appeals: Should your initial grievance be denied, we guide you through the appeals process, including SCAR, ensuring all deadlines are met and your case continues to be strongly advocated.

At Heller & Consultants Tax Grievance, we pride ourselves on our “You Don’t Pay Unless You Save” guarantee. Our fee is typically 50% of the first year’s tax reduction. If we don’t get your taxes reduced, you don’t pay us anything. This ensures we are always working in your best interest. We’ve successfully handled thousands of cases, securing substantial reductions for homeowners across Nassau and Suffolk counties, including Rocky Point, Farmingdale, Deer Park, Brookville, Syosset, Upper Brookville, Massapequa, Stony Brook, and Miller Place.

Conclusion

Understanding what is a property tax grievance empowers you as a Long Island homeowner. It’s a fundamental right that can lead to significant savings, putting more money back into your pocket year after year. Don’t let the complexity deter you from challenging what might be an unfair assessment.

We believe every homeowner deserves a fair assessment and the opportunity to reduce their property taxes. With our “You Don’t Pay Unless You Save” guarantee, Heller & Consultants Tax Grievance makes the process risk-free and accessible. We’ve achieved record reductions in Nassau County ($73,000 annually) and Suffolk County (over $17,000 annually), saving our clients over $30 million in the last decade.

If you suspect your property is over-assessed, it’s time to take action. Let us help you steer the process and fight for the tax reduction you deserve.