Why Understanding Your Nassau Property Tax Grievance Matters

A property tax grievance nassau is your legal right to challenge an unfairly high property assessment. Many Nassau County homeowners overpay on property taxes simply because they don’t know this option exists.

Key facts about filing a property tax grievance in Nassau County:

- What it is: A formal appeal to contest your property’s assessed value.

- Who can file: Property owners, contract buyers, tenants paying taxes, and estates.

- When to file: January 2nd through March 2nd annually (2027/2028 deadline: March 2, 2026).

- Where to file: Nassau County Assessment Review Commission (ARC).

- Cost to file: No fee to file with ARC.

- Risk: None. Your assessment will never be increased as a result of a grievance.

- Main grounds: Excessive, unequal, or unlawful assessment, or misclassification.

Nassau County has some of the nation’s highest property taxes. With average bills often exceeding $10,000, even a small reduction in your assessed value can save you hundreds or thousands of dollars annually. The best part is that filing a grievance is risk-free—your assessment can only be reduced or stay the same.

While the process involves deadlines and evidence, understanding the key steps empowers you to take control. Whether you file on your own or work with a professional, knowing how the system works is the first step to potential savings.

1. Know Your Rights: Eligibility and Deadlines

Before you can challenge your property taxes, you need to know if you’re eligible and when you can file. Think of this as learning the ground rules—once you understand them, everything else falls into place.

Who is eligible to file?

Most people connected to a Nassau County property can file a property tax grievance nassau. Eligibility isn’t limited to the name on the deed.

You can file if you are a:

- Property owner of a one, two, or three-family home, condo, or certain other residential properties.

- Contract buyer in the process of purchasing a property.

- Tenant who is responsible for paying property taxes per a lease agreement.

- Estate representing a deceased homeowner.

Your grievance must apply to the current assessment year; you cannot challenge taxes from previous years.

Key Filing Deadlines

Missing the filing deadline means waiting another year to challenge your assessment and potentially overpaying on taxes. In Nassau County, the annual filing period is from January 2nd to March 2nd.

This deadline is for the tax year that begins about 18 months later. For example, to challenge your 2027/2028 tax assessment, you must file by March 2, 2026. Always confirm the exact dates with the Nassau County Assessment Review Commission, as they can shift for weekends or holidays.

County vs. Village/City Assessments

Many homeowners are confused by Nassau County’s structure. If you live in an incorporated village or city that conducts its own assessments, your property will have two separate assessments:

- County Assessment: Determines your county and school taxes. This is challenged with the Nassau County Department of Assessment.

- Village/City Assessment: Determines your village or city taxes. This is challenged with your local municipality.

These are separate processes with different deadlines. To challenge both, you must file two separate grievances. Village deadlines often differ from the county’s March 2nd cutoff, so check with your local village or city clerk for their specific procedures. Assuming the deadlines are the same is a common and costly mistake.

2. Master the Filing Process: A Step-by-Step Guide

Once you know you’re eligible and have marked your calendar, the next step is understanding how to actually file a property tax grievance nassau. The good news? It’s more straightforward than you might think, and you have options that fit your comfort level.

How to File

You can file your grievance in two ways:

- Online: The easiest method is via AROW (Assessment Review on the Web), the county’s digital portal. It allows you to submit your appeal, upload evidence, and track your status online.

- By Mail/In-Person: Traditional paper forms are also available. You can download them from the ARC website or pick them up in person.

While you don’t need a lawyer to file, the process requires time and expertise to build a strong case. Many homeowners hire a professional service like Heller Tax to manage the process and ensure all details are handled correctly.

Official Forms and Resources

When it comes to filing your grievance, you’ll want to work directly with the official Nassau County sources to make sure you’re using current forms and following proper procedures.

The Nassau County Assessment Review Commission is your central hub for general information about the grievance process. This is where you’ll find updates, announcements, and contact information if you have questions.

For step-by-step instructions on filing—including access to the online AROW system—visit the Appeal Your Assessment page on the Nassau County website. This resource walks you through exactly what you need to do and provides links to the filing portal.

These official websites are updated regularly, so always check them for the most current forms and deadlines.

Required Information

When completing your grievance form, you’ll need to provide the following:

- Owner Information: Name, phone number, and mailing address.

- Property Details: Address, plus the section, block, and lot numbers from your tax bill.

- Current Assessment: The county’s current assessed value for your property.

- Market Value Estimate: What you believe your property was worth on the valuation date (July 1st of the prior year). This is the foundation of your case.

- Requested Reduction: The specific assessed value you are requesting.

Documentation Needed

To build a convincing property tax grievance nassau, you need strong evidence. The more organized your documentation, the better your chances.

Key documents include:

- Comparable Sales Data: Recent sales of similar homes in your neighborhood that support a lower value. These “comps” are crucial.

- Recent Appraisals: A professional appraisal provides an expert opinion of your property’s market value.

- Photographs: Document any issues that lower your home’s value, such as needed repairs or outdated features.

- Property Record Discrepancies: Proof of errors in the county’s records, like incorrect square footage or number of rooms.

- Contractor Estimates: Quotes for significant repairs can demonstrate a lower market value.

At Heller Tax, we handle all evidence-gathering for you, using our expertise to build the strongest possible case. With our “You Don’t Pay Unless You Save” guarantee, there’s no risk.

3. Build Your Case: Grounds and Evidence for a Property Tax Grievance Nassau

Now that you’re ready to file, it’s time to understand why you’re filing. A property tax grievance nassau isn’t just about feeling your taxes are too high—it’s about proving your assessment is legally incorrect. Think of it like building a case in court: you need solid grounds and evidence to back up your claim.

In New York State, there are four main legal grounds for filing a property tax complaint. For a more extensive overview, you can download a copy of the publication Contesting Your Assessment in NY State here. The NYS Department of Taxation and Finance also provides grievance procedures that offer valuable insights.

Let’s walk through each ground so you can determine which one fits your property’s situation.

Ground 1: Excessive Assessment (Overvaluation)

This is the most common ground for a property tax grievance nassau. It means your property’s assessed value is higher than its actual market value. An excessive assessment can be claimed for several reasons:

- Overvaluation: Your primary argument is that the assessor’s market value for your home is too high. You prove this by showing that comparable homes sold for less than your property’s assessed value as of the valuation date (July 1st of the prior year).

- Incorrect Partial Exemptions: Your assessment may be excessive if you were wrongly denied or received an incorrect calculation for exemptions like STAR, Senior Citizen, or Veteran’s. You’ll need to provide proof of eligibility or the application.

- Transition Assessment Errors: During a revaluation, new values are often phased in over several years. If this “transition assessment” is calculated incorrectly for your property, you can challenge it.

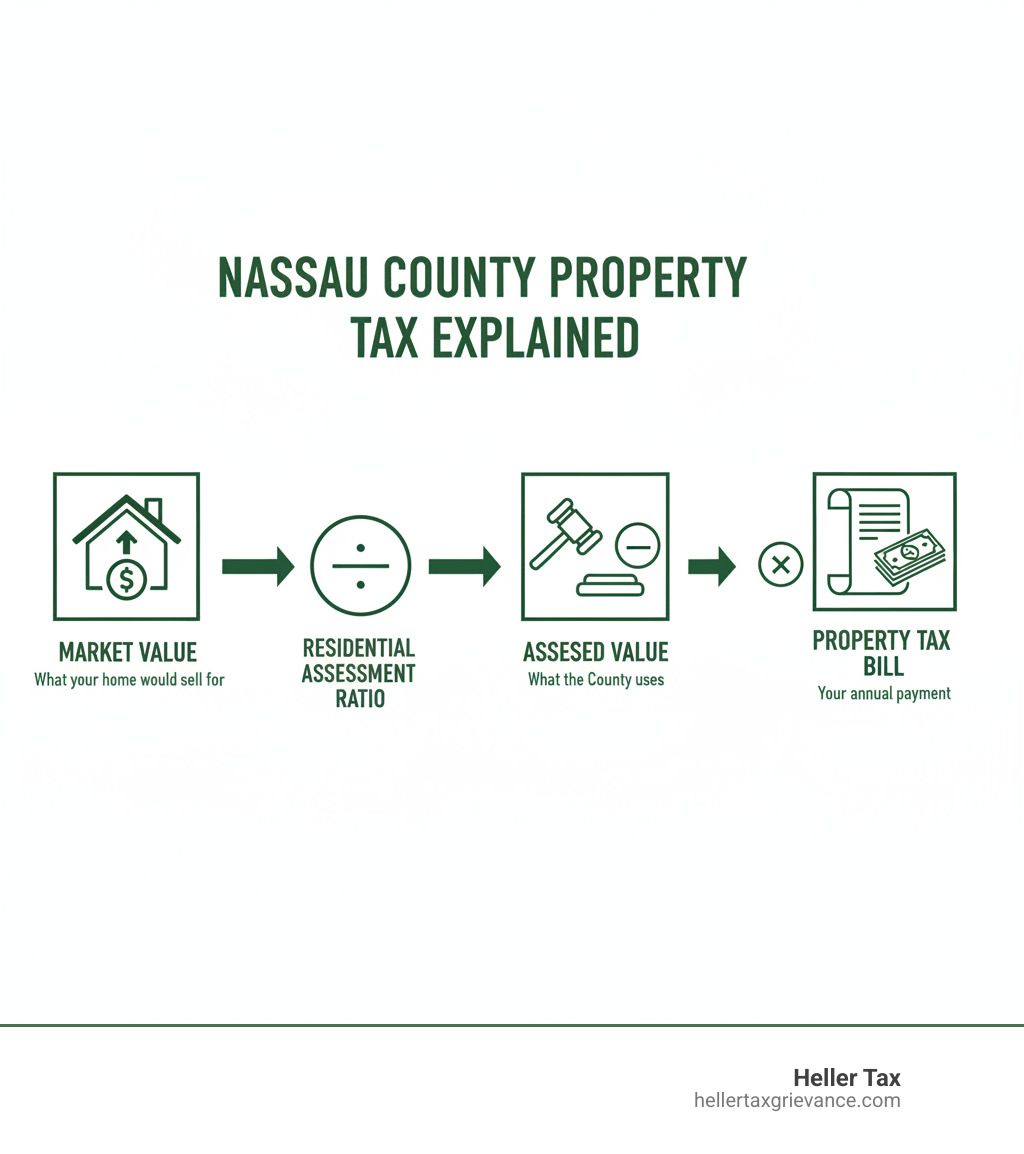

Ground 2: Unequal Assessment

This argument is about fairness. You claim your property is assessed at a higher percentage of its market value than the average for other properties in your municipality.

For example, if your home is assessed at 80% of its market value, but the average for other homes is only 60%, your assessment is unequal. To prove this, you must establish the average level of assessment using one of these official figures:

- The state’s Equalization Rate

- The Residential Assessment Ratio (RAR)

- The Uniform Percentage of Value listed on the assessment roll

You can then argue that your property’s assessed value should be reduced to match this lower, average percentage.

Ground 3: Unlawful Assessment & Misclassification

These grounds are less common but address fundamental legal errors.

An unlawful assessment occurs if:

- Your property is legally exempt from taxes (e.g., owned by a religious organization).

- The property is located outside the assessing unit’s boundaries.

- The assessment was made by an unauthorized person.

Misclassification applies if your property is in the wrong tax class. For example, if your one-family home (homestead) is incorrectly classified as a commercial property (non-homestead), you may be paying a higher tax rate. This also applies to incorrect splits on mixed-use properties.

Understanding these grounds helps you build the right case. At Heller Tax, our experience allows us to identify the best argument for your property, which is how we’ve saved homeowners over $160 million.

4. Weigh the Costs vs. Benefits: Is Filing Worth It?

It’s natural to wonder if filing a property tax grievance nassau is truly worth your time. We get it—you’re busy, and the idea of dealing with government paperwork might sound about as appealing as a root canal. But here’s the thing: when you understand the minimal risks and the potential for real savings, the answer becomes pretty clear.

Potential Risks of Filing

The biggest fear homeowners have is that filing a grievance will cause their taxes to go up. Let’s be perfectly clear: The Nassau County Assessment Review Commission (ARC) will never increase your property’s assessment as a result of a grievance.

There are only two possible outcomes: your assessment is reduced, or it stays the same. There is zero risk of an increase. Filing a property tax grievance nassau is a free shot at lowering your taxes with no downside.

Costs of Filing Independently

Filing your initial complaint with the ARC is free. The real cost of filing on your own is time and effort. You are responsible for researching comparable sales, gathering all documentation, correctly completing forms, and meeting deadlines. This can be an overwhelming process for many homeowners.

If your grievance is denied and you appeal to Small Claims Assessment Review (SCAR), there is a small, $30 court-imposed filing fee.

Benefits of Using a Professional Service

While you can file on your own, many homeowners prefer to use a professional service like Heller Tax to save time and leverage expertise. Our service is designed to maximize your savings with no financial risk.

- No Upfront Fee: We charge nothing to get started. We are confident in our ability to get you results.

- “You Don’t Pay Unless You Save” Guarantee: Our fee is a percentage of the tax savings we achieve for you. If we don’t save you money, you owe us nothing.

- Proven Track Record: We have saved Long Island homeowners over $160 million and have secured some of the largest tax reductions in Nassau and Suffolk counties.

- We Handle Everything: Our team manages the entire process, from research and evidence gathering to filing and representation at hearings. You get peace of mind knowing experts are fighting for you.

The choice between filing yourself and using our service comes down to how you value your time. Both options are risk-free, but working with us ensures your case is as strong as possible without taking up your valuable time.

5. Steer the Aftermath: From ARC Decision to Next Steps

You’ve done it—you’ve filed your property tax grievance nassau! Now comes the waiting game. But don’t worry, we’re here to walk you through what happens next and what options you’ll have depending on the outcome.

The Post-Filing Timeline

After you file, the Nassau County Assessment Review Commission (ARC) reviews your evidence. They have until March 31st of the year following your filing to issue a decision. For a grievance filed by March 2, 2026, a decision is typically made by March 31, 2027.

During this period, ARC may extend a settlement offer for a reduced assessment. If we represent you, we will analyze this offer and advise you on the best course of action.

Possible Outcomes

Your property tax grievance nassau can have several outcomes:

- Full or Partial Reduction: ARC agrees to lower your assessed value, resulting in tax savings.

- Grievance Denial: ARC determines your current assessment is fair. You can still appeal this decision.

- Stipulation Agreement: A formal settlement offer for a reduced assessment. Accepting this usually closes the case for that year.

Impact of a Successful Grievance

A successful grievance means your reduced assessment will be applied to future tax bills, starting with the October school tax bill and then the January general tax bill. These savings continue annually.

If the reduction is granted after you’ve paid taxes on the higher assessment, you are entitled to a refund for the overpayment. This can result in substantial long-term savings, often adding up to thousands of dollars over the years you own your home.

Options if Your Grievance is Denied

If ARC denies your grievance, you can appeal through judicial review. The most common path for homeowners is Small Claims Assessment Review (SCAR).

SCAR is a less formal process for owners of one, two, or three-family homes. Key details include:

- Filing Window: Typically April 1st to April 30th, after ARC’s decision.

- Filing Fee: $30.

- Frequency: You can file a SCAR petition every other year for the same property.

More information is available from the New York State Unified Court System. For more complex cases or commercial properties, a formal tax certiorari proceeding is another option. Heller Tax can guide you through these appeal processes to continue fighting for a fair assessment.

Frequently Asked Questions about Nassau Property Tax Grievances

You’ve made it this far, and we’re so glad you’re taking the time to understand your rights! Before we wrap up, let’s address a few questions that nearly every Nassau County homeowner asks us. These are the real-world concerns we hear day in and day out, and we want to make sure you have clear, straightforward answers.

Can I file a property tax grievance nassau every year?

Yes, you can and should file a property tax grievance nassau with the Assessment Review Commission (ARC) every year. Market conditions change, and filing annually ensures you are never over-assessed. While you can file with ARC every year, please note that you can only file a Small Claims Assessment Review (SCAR) petition every other year for the same property.

Will my assessment increase if I file a property tax grievance nassau?

No. The Nassau County Assessment Review Commission (ARC) is legally prohibited from raising your assessment as a result of a grievance. When you file a property tax grievance nassau, your assessment can only be reduced or stay the same. There is no risk of an increase.

What’s the difference between a county and village grievance?

Your county assessment determines your county and school taxes and is grieved with the Nassau County ARC (deadline is March 2nd). If you live in an incorporated village or city that has its own assessor, you will also have a separate village/city assessment for your village/city taxes. This requires a separate grievance filed directly with your village/city, which has its own unique deadline. To challenge both, you must file two separate grievances.

Conclusion: Take Control of Your Nassau County Property Taxes

You now have the knowledge to take control of your property taxes. You understand your rights, the critical March 2nd deadline, how to build a case, and that there is no risk in filing a property tax grievance nassau.

Nassau County’s property taxes are among the highest in the nation. A successful grievance can put hundreds or thousands of dollars back in your pocket each year. You have two choices: file on your own or let a professional handle it.

At Heller Tax, we’ve saved Long Island homeowners over $160 million. We offer a “You Don’t Pay Unless You Save” guarantee, meaning there is no upfront cost and no fee unless we reduce your taxes. We handle all the research, paperwork, and hearings, giving you peace of mind and expert representation.

Whether you file yourself or partner with us, the most important step is to take action. Don’t overpay for another year. You have the tools to fight for a fair assessment.