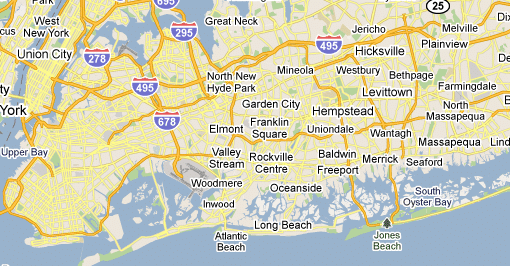

Long Island Tax Reduction Process Made Easy

Contrary to popular belief, the process of real estate tax reduction is not lengthy. In fact, with the right Tax Grievance firm, your grievance will be settled successfully and quickly. The Heller & Consultants Tax Grievance is the Long Island Tax Grievance agency that you need to file your case and reduce your taxes without […]

Long Island Tax Reduction Process Made Easy Read More »