Don’t worry. Many people are simply too busy with their daily lives to be able to master the industry for getting property tax reductions in Nassau County. Below we will break down some of the basics behind this process and how Heller & Consultants Tax Grievance Group can handle this process for you.

We Can Help You Out

We understand the dilemma of living a normal life with responsibilities can take a toll on your capability to handle things such as property tax grievances. Therefore, we are happy to assist you during this process.

The main idea here is that we will need to file your tax grievance before the Nassau County deadlines. These occur 18 months before the tax year that you want to challenge.

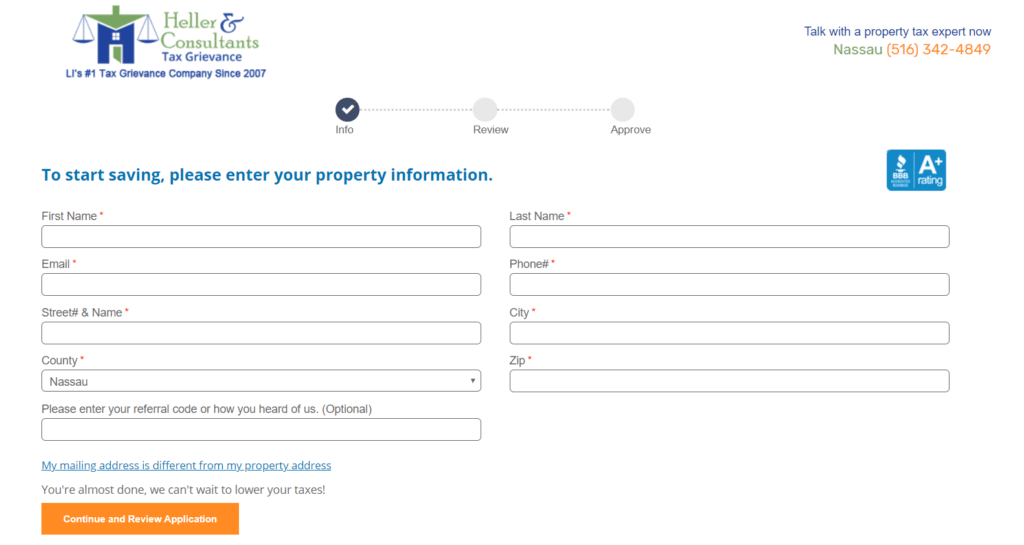

Click here to start with this process

How Often Should I File Tax Grievance?

We advise our clients to file for tax grievances each tax season. As we will discuss with you should you become our client, there are many different reasons for this. The main reason to keep in mind for this, though, is due to the fact that taxes will rise each year naturally. Once you start to see how much money you can save on property taxes, you will want to file grievances each year!

What Are the Risks Involved?

You have nothing to lose, but your taxes. We want you to put your faith in us. To make this possible, we will only charge we successfully win your case. Of course, you will still need to apply with us before we can confidently commit to you.

After taking a good look at your case, we will generally know right away whether or not we think we help you out. Since we have developed over a decade of expertise and helped our clients in the past save over $35 million in property taxes, we are confident enough in our service to only charge you afterward.

Most importantly, we only charge you a proportion of the savings that you receive. This way, both of us can properly benefit. At the end of the day though, the only risk you play is having your Nassau County property assessment remain the same.

Professional Appeals for Your Assessed Property Value

To be clear, we are not able to challenge the total amount of taxes that you pay. You will only be able to potentially receive a lower assessed property value. Once we are able to successfully lower your property’s assessed value, this will reflect in the total amount that you pay in taxes.

Therefore, we are only capable of indirectly lowering your property taxes. This is done by lowering the value of your property in the eyes of Nassau County.

How to Get Started

After we decide to take on your case, we will then work diligently file all the necessary paperwork in a timely manner and make any court appearances.

Once we file the paperwork, we will handle all communication with the Nassau County Assessment Review Commission.

You Don’t Pay Until We Win

Although we cannot promise each of our clients a victory and lowered home value, we are confident in our ability to do so. Throughout the years, we have developed quite a bit of knowledge and expertise on how this industry works. This is partially why we will only be in touch with you for billing after we successfully lower your property’s value.

What happens If We Lose?

In the rare event that we lose and your property value remains the same, we will immediately be in contact with you. Keep in mind that this doesn’t necessarily mean that there are no further options. We will discuss things with you such as filing an appeal in the Supreme Court, and any other options that may be necessary afterward.

When Will I Get Billed?

Once we successfully lower your property tax assessment, we will be in touch with you promptly to discuss the total level of savings that you experience. However, you will not be billed until Nassau County publishes your tax bills.