Smart Money Moves for Homeowners

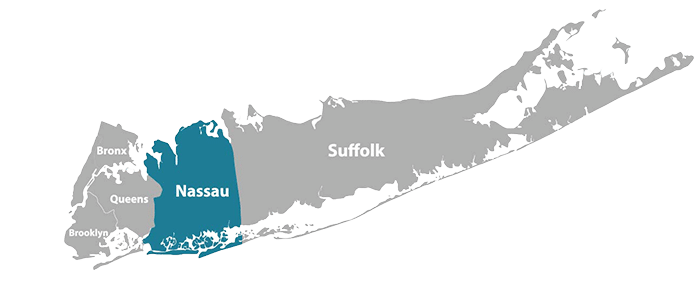

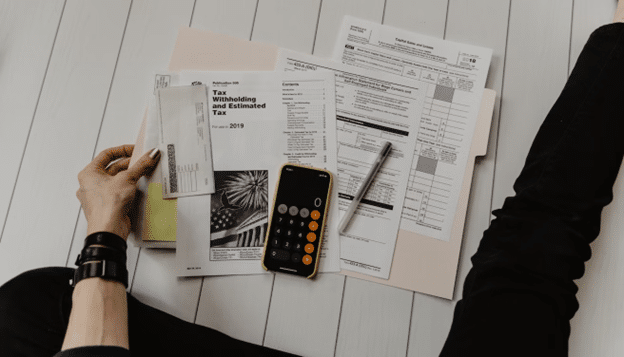

Setting financial goals is a crucial part of maintaining a healthy relationship with money. For a homeowner, this is especially evident. Owning a home is a huge, important investment, and all homeowners should be aware of the smart financial money moves they should be making. Without realizing it, your home could play an important role […]

Smart Money Moves for Homeowners Read More »