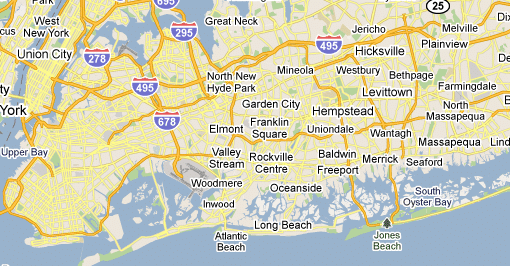

Nassau County Grievance Filing On Property Tax

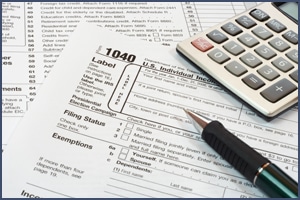

As of 2 January 2018, The Nassau County Department of Assessment carried out an assessment on each property in the region. At times, the assessments might be inaccurate. The question here is “What would you do if you got an inaccurate property assessment?” Well, you can make an appeal whereby you fill an application with […]

Nassau County Grievance Filing On Property Tax Read More »