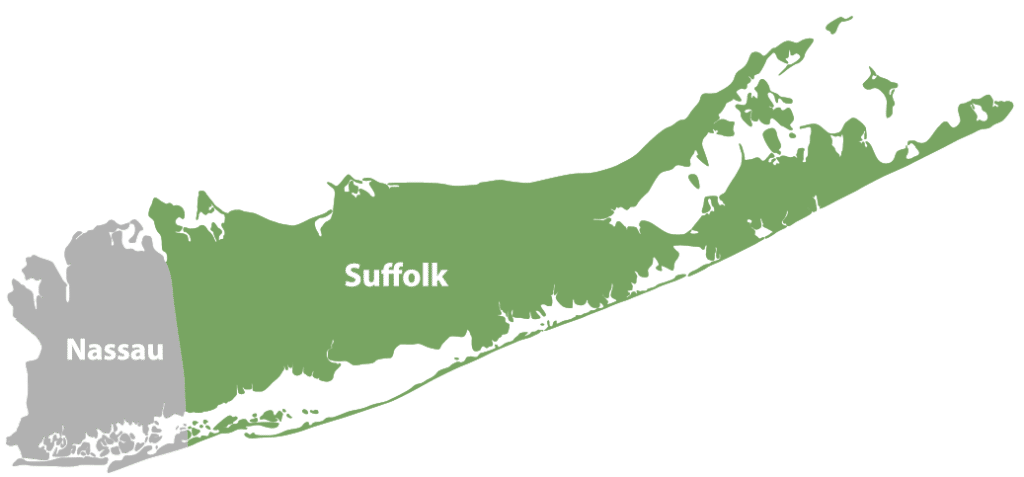

Suffolk County: known for its rich soil, expansive 1,000+ mile coastline… and high property taxes!

Being located in New York State, it’s a given that Suffolk County will have some of the highest property taxes in the country. But that doesn’t mean residents are stuck paying those high prices. With the help of Heller & Consultants Tax Grievance, your property taxes can be reduced to their lowest legal limit.

Why choose to work with Heller & Consultants Tax Grievance? As Long Island’s “#1 Tax Grievance Company,” our reputation guarantees a hassle-free, expert-driven process to start saving you money on your property bill. When you choose to work with us, you’re choosing the very best firm for tax grievances.

Table of Contents

- Complete Guide for 2023 Property Taxes in Suffolk County

- Perks of Working With Heller Tax Grievance

- You Pay Nothing Up Front

- Our Tax Grievance Assessment is Hassle-Free

- Incredible Track RecordTax Reductions

- Property Tax Assessment Process

- How to Calculate Your Suffolk County Property Tax Rate:

- 2019 Median Tax Bill Data:

- How to Calculate Your Property Tax:

- Municipal and School District Tax Rates

- How to Get a Copy of Your Tax Records

- How to Make a Tax Payment

- Municipality Tax Rates and Payment Instructions

- Town of Babylon Instructions

- Town of Brookhaven Instructions

- Town of East Hampton Instructions

- Town of Huntington Instructions

- Town of Islip Instructions

- Town of Riverhead Instructions

- Town of Shelter Island Instructions

- Town of Smithtown Instructions

- Town of Southampton Instructions

- Town of Southold Instructions

- Contact Your Department of Assessment For Questions

- Start Saving Money and File a Tax Grievance Today!

- Property Tax Exemptions

- STAR Program

- Veterans’ Exemptions

- Senior Citizens’ Exemption

- Limited Income/Disabilities Exemption

- FAQs:

- How Much Is Property Tax in Suffolk County & When Are Taxes Due?

- How Do I Pay My Tax Bill?

- Suffolk County Property Taxes Causing You Grief? Let Heller Tax Grievance Help!

Perks of Working With Heller Tax Grievance

Looking for some help with tax grievances in Suffolk County but not sure if Heller Tax Grievance is right for you? Here are some of the main reasons you should consider hiring us!

You Pay Nothing Up Front

During the reassessment process, your taxes can only go down. Plus, we only get paid if you do. You owe us nothing if we can’t lower your property tax bill!

Our Tax Grievance Assessment is Hassle-Free

Our assessment process is completely virtual and easy to follow, and we handle it all, so you don’t have to. Just pick up the phone or fill out our contact form, and one of our experts will start the process of seeing how much we can save you in property taxes.

Incredible Track RecordTax Reductions

In recent years, we have saved our clients over $60,000,000 through property tax grievances.

Suffolk County already has some of the highest property tax rates in the country. Don’t leave your tax assessment up to the state of New York. When you work with Heller Tax Grievance, you are ensuring you are getting the best possible tax percentage at the lowest legally permitted rate.

Our tireless efforts to save customers money extend to anyone dealing with property taxes. Whether you are working in real estate, a first-time buyer, or a landlord for a commercial property, let us help you maximize your savings by getting the lowest possible tax rate.

What now? Follow this guide for a breakdown of tax rules and requirements in Suffolk County, and then contact us today for a complimentary assessment. Be sure to submit your request before the 2023 tax deadline of May 16th, 2023.

Property Tax Assessment Process

Every individual tax district holds an annual budget meeting to balance the books. The district knows the amount of money its budget requires. This budget is funded from two places: (1) revenue from The State of New York and (2) property taxes.

During this meeting, estimated calculations are made to determine what kind of revenue can be expected from the State of New York. This revenue includes sales tax, user fees, and government assistance.

The amount of property tax assessed each year is also determined during this budget meeting, where the total amount of the budget given by New York State is subtracted from the budgetary needs of the district. This leftover amount of budget needed is recovered through property taxes.

But how are property taxes determined for individual establishments and homes? Individual tax assessments on properties depend upon the building’s assessed value.

What is your property’s assessed value? It is the market value of your home multiplied by your individual district’s level of assessment (LOA).

A level of assessment (LOA) determines what percentage of market value your district charges. This means that your property tax assessment could range from 5% of market value all the way up to 100% of market value depending upon which district or municipality you reside within.

How to Calculate Your Suffolk County Property Tax Rate:

Suffolk County is in the top ten for most expensive counties in the United States, but depending upon where you live, you might find that you pay more or less than one of your neighboring districts.

While Suffolk County’s average tax rate is not as high as Nassau County’s, it is still over $1,000 higher than New York State’s average.

2019 Median Tax Bill Data:

- Nassau County’s median tax bill: $14,872

- Suffolk County’s median tax bill: $9,472

- New York median tax bill: $8,081

- United States’ median tax bill: $3,399

If you accept the median Suffolk County tax assessment, then over ten years’ time you are going to pay nearly $14,000 more than the average New York resident and over $60,000 more than the average American. For this reason, it is important that you know how to calculate your property taxes and contact us for a free quote if you believe your tax rate is too high.

The tax grievance process is simple and our experts are happy to help bring your property costs down.

How to Calculate Your Property Tax:

Before calculating your property tax rate, you will need to know the following:

- Your home’s market value

- Your municipality’s LOA (level of assessment)

- Your municipality’s tax rate

Take your home’s market value and multiply it by the equalization rate. This number will give you your total assessed value. Click here for the assessed value ratios of different towns in Suffolk County.

Next, you will need to find your total tax rate. Finding your total tax rate in Suffolk County can be challenging because of the varying types of taxes imposed. Depending upon which district you reside within, you may be responsible for additional tax additions, including

- School district taxes

- Library taxes

- County taxes

- Town taxes

- Village taxes

- Utility taxes

- District taxes

What is the formula for the total tax rate? School district rate + library district rate + combined code rate = total tax rate.

Finally, multiply your total assessed value by the total tax rate of your municipality’s LOA.

For reference, while making your calculations, use these maps to find tax districts within Suffolk County.

Consider the following example to help:

“Property in Setauket in the Town of Brookhaven has a full market value of $717,000. The uniform percentage of value is 0.10. That results in an assessed value of $717. The town and county assess at 100% of this assessed value.

You can then multiply this taxable assessed value by the tax rate of the municipality.”

Municipal and School District Tax Rates

Long Island has over 125 school districts, 10 towns, 64 villages, and over 100 municipal corporations.

Because of the multitude of different zones and varying rates imposed by different districts, companies, and municipalities, living even one street over can make a major difference in your property tax bill. Further, it can lead to a lot of confusion when it comes to calculating your personal property tax rate.

You may find it simpler to get a copy of your previous tax records instead of calculating the number yourself.

How to Get a Copy of Your Tax Records

Whether you are in need of a copy of your tax history or are simply curious about previous rates, your records are viewable online.

The Suffolk County Property Records Search lets you see historical tax data after entering your property’s address.

The Property Records Search gives residential property information, including

- Property owners

- Sales & transfer history

- Deeds & titles

- Valuations

- Land

- Zoning records

How to Make a Tax Payment

The Suffolk County Receiver of Taxes is responsible for collecting each municipality’s annual property taxes. This collection window lasts from December 10th through May 31st, with the first installment coming due on January 10th and the second installment being owed on or before May 31st.

Late payments come with a penalty, beginning at a rate of 1% and increasing every month that the payment is late.

- 1 – Jan. 10: No penalty

- 11 – Feb. 10: 1% penalty

- 11 – Mar. 10: 2% penalty

- 11 – Apr. 11: 3% penalty

- 12 – May 10: 4% penalty

- May 11 – May 31: 5% penalty

After May 31st, late payments become delinquent and incur another 5% penalty. Additionally, the collection window closes, and these delinquent taxes must be paid through the Suffolk County Comptroller’s Office.

Checks can be mailed to

Suffolk County Comptroller

330 Center Drive

Riverhead, NY 11901

If you need assistance making a payment or navigating the treasurer’s website, you can call 631.852.3000 for assistance Monday – Friday from 9 am – 5 pm.

Municipality Tax Rates and Payment Instructions

Town of Babylon Instructions

Town of Babylon, NY Tax Department

Address: Memorial Village Hall, 430 S. Wellwood Ave,

Lindenhurst, NY 11757

Phone: 631.957.3014

Head to the Town of Babylon Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of Brookhaven Instructions

Town of Brookhaven Tax Department

Address: 1 Independence Hill,

Farmingville, NY 11738

Phone: 631.451.6300

Head to the Town of Brookhaven Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of East Hampton Instructions

Town of East Hampton Tax Department

Address: 300 Pantigo Place Suite 108,

East Hampton, NY 11937

Phone: 631.324.4187

Head to the Town of East Hampton Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of Huntington Instructions

Town of Huntington Tax Department

Address: Town Hall (Room 100), 100 Main Street,

Huntington, NY 11743

Phone: 631.351.3226

Head to the Town of Huntington Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of Islip Instructions

Address: 40 Nassau Avenue,

Islip, NY 11751

Phone: 631.224.5585

Head to the Town of Islip Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of Riverhead Instructions

Town of Riverhead Tax Department

Address: 200 Howell Avenue,

Riverhead, NY 11901

Phone: 631.727.3200

Head to the Town of Riverhead Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of Shelter Island Instructions

Town of Shelter Island Tax Department

Address: 38 North Ferry Road, PO Box 1854

Shelter Island, NY 11964

Phone: 631.749.3338

Head to the Town of Shelter Island Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of Smithtown Instructions

Town of Smithtown Tax Department

Address: 40 Maple Avenue

Smithtown, NY 11787

Phone: 631.360.7610

Head to the Town of Smithtown Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of Southampton Instructions

Town of Southampton Tax Department

Address: Town Hall, 116 Hampton Rd,

Southampton, NY 11968

Phone: 631.283.6020

Head to the Town of Southampton Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Town of Southold Instructions

Town of Southold Tax Department

Address: Southold Town Hall, Tax Receiver’s Office, 53095 Route 25,

Southold, NY 11971

Phone: 631.765.1803

Head to the Town of Southold Online Portal to make property tax payments.

Tax Due Dates:

- First installment: January 10th

- Second installment: May 31st

Contact Your Department of Assessment For Questions

In Suffolk County, the Assessor’s Office is run by individual municipalities.

You should contact your local Assessor’s Office if you have any questions about how property tax assessment works, property records, or other public inquiries.

Start Saving Money and File a Tax Grievance Today!

Heller Tax has been serving members of the Suffolk County community for years. See what our firm’s expert knowledge can do for your tax bill.

With property tax rates higher in Suffolk County than anywhere else in the United States, let’s ensure you aren’t paying above the minimum. At Heller Tax Grievance, we guarantee that we can get you the lowest, legally permissible rate.

To start the grievance process with us, call one of our experts at 516.342.4849 or go online for a free quote. Our process is easy, hassle-free, and entirely virtual!

Be sure not to delay the appeals process!

While we are happy to help year-round with starting your tax grievance process, Suffolk County does have a deadline of May 16th, 2023.

To make sure you are saving the most possible money and getting the lowest legal rate, give us a call and start the risk-free process today.

Property Tax Exemptions

Beyond reducing your property tax through a grievance process, you should also know about some exemptions offered to residents of the state of New York.

These exemptions are available to a range of qualifying candidates, including those who suffer from severe mental or physical limitations, low-income households, and senior citizens with income-related needs.

Note: property tax exemptions must be filed on or before January 2nd, 2023, for the 2023/2024 programs.

STAR Program

The School Tax relief (STAR) program offers mail-in check assistance to aid with the property taxes of eligible New York homeowners.

Basic STAR Program: For applicants who meet the annual income cap (up to $500,000 per household), the STAR program will mail checks to aid with the cost of property tax rates.

Enhanced STAR Program: Senior Citizens who meet the income requirements are eligible for New York State’s enhanced STAR Program, which helps cover the burden of property taxes in Suffolk County.

Veterans’ Exemptions

Veterans have three different options for property tax exemption in Suffolk County. If you think you may qualify for one of these exemptions, be sure to check the requirements here.

Senior Citizens’ Exemption

Individual towns, cities, and villages are authorized to permit senior citizens over 65 years of age to be eligible for a property tax reduction. If permitted, these property tax reductions can relieve up to 50% of the tax assessment.

Limited Income/Disabilities Exemption

Exemptions for residents who suffer from debilitating or limiting physical and mental conditions should check with their local rules on exemptions. These property tax exemptions, when offered, can mean up to a 50% reduction in property tax.

FAQs:

How Much Is Property Tax in Suffolk County & When Are Taxes Due?

Generally, property taxes in Suffolk County use the following payment schedule:

- First installment: January 10th

- Second installment: May 31st

Because Suffolk County has such a wide range of variability in types of taxes (including school district taxes, special district taxes, and utility district taxes), it is important to always check with your specific district for the most up to date information and comprehensive list of deadlines.

How Do I Pay My Tax Bill?

Check above for options for paying your property tax bill online. Remember that late tax payments are subject to late fees. Further, payments made after May 31st are considered delinquent and can only be paid through the Suffolk County Comptroller’s Office.

Late payments come with a penalty, beginning with a rate of 1% and increasing every month that the payment is late.

- 1 – Jan. 10: No penalty

- 11 – Feb. 10: 1% penalty

- 11 – Mar. 10: 2% penalty

- 11 – Apr. 11: 3% penalty

- 12 – May 10: 4% penalty

- May 11 – May 31: 5% penalty

After May 31st, late payments become delinquent and incur another 5% penalty. Additionally, the collection window closes, and these delinquent taxes must be paid through the Suffolk County Comptroller’s Office.

Suffolk County Property Taxes Causing You Grief? Let Heller Tax Grievance Help!

Heller & Consultants Tax Grievance makes the process pain-free! All you need to do to start our risk-free process is fill out our online form or give us a call, and we will handle the rest. You won’t need to show up in person, as our process is entirely virtual. Remember: we don’t get paid if you don’t, so there’s nothing to lose!

Heller & Consultants Tax Grievance can help you lower your property tax rates. Contact us today for a free quote and start saving money!