Our company holds the reputation of having the highest property tax reductions of any other tax company in Long Island. That means when you choose us, you’re choosing the one firm that has proven countless times that we’re great at saving our clients money now and in the long run.

Table of Contents

- A Proven System In a Notoriously Expensive County

- Nassau County Property Tax Breakdown:

- Curious About Previous Taxes?

- How is Property Tax Assessed?

- Calculate Your Personal Nassau County Property Tax Rate:

- 2019 Median Tax Bill Data:

- 2021 Nassau County Municipal Tax Rates

- Nassau County Property Tax Rates for School Districts (2021)

- Sample School District Tax Rates:

- Town of North Hempstead:

- Town of Oyster Bay:

- Property Tax Exemptions:

- STAR Program

- Veterans’ Exemptions

- Senior Citizens’ Exemption

- Limited Income/Disabilities Exemption

- First Responders’ Exemption

- How to Make a Tax Payment

- Individual Municipality Tax Payment Instructions

- Long Beach Instructions

- Hempstead Instructions

- Glen Cove Instructions

- North Hempstead Instructions

- Oyster Bay Instructions

- How Much Is Property Tax in Nassau County, and When Are Taxes Due?

- How Do I Pay My Tax Bill?

- Is It Easy to Begin the Tax Grievance Process?

A Proven System In a Notoriously Expensive County

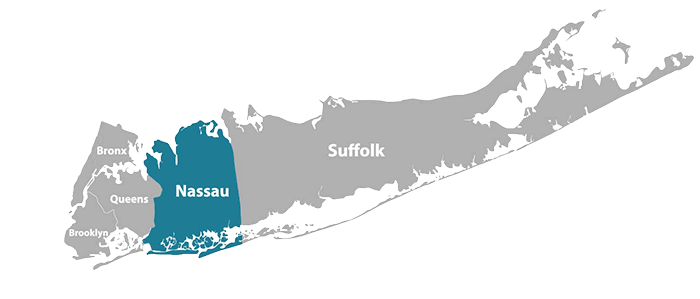

Nassau County, NY, is already known as one of the most expensive places in the U.S. Let’s make sure property taxes don’t add to that total. With some of the country’s highest real estate property taxes, purchasing a home or property on Long Island can be daunting!

If you rely upon Nassau County officials to reassess or determine your rates, you may end up paying thousands extra per year. But when you work with us at Heller Tax Grievance, you can rest easy knowing that we’ll labor tirelessly to get you the lowest legally allowed percentage.

Proof that our method works: We have saved our clients over $60,000,000 in recent years, with some property tax bills slashed by over $80,000 over a 10-year span (calculated at today’s max rate).

We all love saving money, but you might be wondering who benefits from our service, and the answer is clear: anyone dealing with property taxes! This includes real estate agents, homeowners, first-time buyers, and commercial property landlords. If you have a property tax bill in Nassau county, we can help you get the lowest possible rate.

What now? Check out our quick guide on what you need to know about our services, and then start planning what you’ll do with your anticipated savings!

Nassau County Property Tax Breakdown:

Ever wondered what goes into your property tax total? For residents of Nassau County, the answer will depend upon where you live and will potentially include any of the following:

- Nassau County Taxes

- Municipality Taxes

- Village Taxes

- School District Taxes

- Special District Taxes

Why are some of these numbers in a property tax bill? Shouldn’t schools be funded through county tax rates? While some counties, such as Suffolk , include school taxes in their county rates, Nassau County tacks it onto their property bills.

During the annual budget meeting for each tax district, revenue from the State of New York (including sales tax, user fees, and aid) is totaled up and compared against the district’s needs. Whatever amount is still needed to reach the budget goal is then turned into a property tax rate.

Curious About Previous Taxes?

Whether you are in need of a copy of your tax bill or are simply curious about previous rates, your records are viewable online.

The Nassau County Land Records Viewer lets you see historical tax data after entering your address, SBL, or landmark information.

Other information you can get from the Land Records Viewer:

- Nassau County Tax District Boundaries

- Present and Past Tax Data

- Previous Tax Payments

- Assessment Roll Information

- Property Tax Assessment Photographs

- Tax Exemption Lists and Amounts

- Comparable Home Sales

Beyond the Land Records Viewer, local municipalities also offer options for looking up individual property taxes:

- Oyster Bay Property Tax

- Long Beach Property Tax

- Hempstead Property Tax

- North Hempstead Property Tax

- Glen Cove Property Tax

How is Property Tax Assessed?

While the total revenue earned through property taxes is determined in annual district meetings, individual tax assessment is determined based on your home’s assessed value.

What is your property’s assessed value? It is the market value of your home multiplied by your individual district’s level of assessment (LOA).

This means that your property’s tax assessment could vary from 5% all the way to 100% market value, depending upon your municipality’s LOA.

Because municipalities differ in their LOAs, New York uses equalization rates.

What is an equalization rate? It is the total assessed value of a property divided by its total market value. These rates are necessary because assessment percentages differ based on municipality, there is no set assessment percentage, and more than 700 of New York’s schools function within multiple tax districts.

Calculate Your Personal Nassau County Property Tax Rate:

Given that Nassau County is one of the most expensive counties in the United States, it is no surprise to learn that Nassau County residents pay more than 4x what the average American pays in property taxes.

While SmartAsset places Nassau County’s average tax rate at 2.24%, it is worth remembering that property tax amounts and percentages vary based on individual municipalities. To give you an idea of this variability: tax rates in Nassau County can range from .03 to 18.05 per $1,000, along with school district tax rates stretching from 10.68 to 42.63 per $1,000.

2019 Median Tax Bill Data:

- Nassau County’s median tax bill: $14,872

- Suffolk County’s median tax bill: $9,472

- New York median tax bill: $8,081

Ever wondered how to calculate your individual tax rate? Or curious how your property taxes compare to your friend’s or family’s bills? While there are online calculators available to help you predict your property tax amount, below is a quick sketch of how to find the estimate yourself.

Calculate your Nassau County Property Tax:

Before calculating your property tax rate, you will need to know the following:

- Your home’s market value

- Your municipality’s LOA (level of assessment)

- Your municipality’s tax rate

Take your home’s market value and multiply it by the equalization rate. This number will give you your total assessed value.

Next, multiply your total assessed value by the tax rate of your municipality’s LOA.

Consider the following example:

“Property in Roslyn Heights in the Town of North Hempstead has a full market value of $717,000. The uniform percentage of value is 0.10. That results in an assessed value of $717. The town and county assess at 100% of this assessed value.

You can then multiply this taxable assessed value by the municipality’s tax rate.”

Municipal and School District Tax Rates:

The 2021 Nassau County tax rate was 5.15 per $1,000; however, this tax rate does not include the municipal, school district, or special district taxes. Below is information on the 2021 municipal and school taxes, but you should always check with your local district for the most up-to-date and comprehensive list of taxes.

2021 Nassau County Municipal Tax Rates

| Municipality | Tax Rate (Per $1,000 of Full Value) |

| City of Glen Cove | 7.45 |

| City of Long Beach | 7.21 |

| Town of Hempstead | 2.58 |

| Hempstead villages | 1.85 (East Rockaway) to 18.05 (Hempstead) |

| Town of North Hempstead | 1.49 |

| North Hempstead villages | 0.92 (Plandome Heights) to 7.36 (Lake Success) |

| Town of Oyster Bay | 4.60 |

| Oyster Bay villages | 0.68 (Farmingdale) to 5.32 (Centre Island) |

Nassau County Property Tax Rates for School Districts (2021)

| Municipality | Equalization Rate | Tax Rate (Per $1,000 of Full Value) |

| City of Glen Cove | 100.0 | 7.45 |

| City of Long Beach | 3.28 | 7.21 |

| Town of Hempstead | 0.18 | 2.58 |

| Town of North Hempstead | 0.17 | 1.49 |

| Town of Oyster Bay | 0.17 | 4.60 |

Head to the 2022 Nassau County Assessment Rolls to see information on current tax rates, equalization rates, and assessment levels.

Sample School District Tax Rates:

- Town of Hempstead:

- Westbury: 9.57

- Uniondale: 11.60

- Freeport: 16.33

- Hempstead: 18.31

- Merrick: 33.42

- Hewlett-Woodmere: 33.97

- North Bellmore: 34.31

- Levittown: 42.53

Town of North Hempstead:

- Great Neck: 14.0

- Manhasset: 14.21

- Roslyn: 20.40

- Herricks: 29.77

- East Willston: 29.78

- Jericho: 37.14

Town of Oyster Bay:

- Roslyn: 10.68

- Jericho: 20.72

- Syosset: 24.12

- Farmingdale: 26.95

- Plainedge: 33.89

Property Tax Exemptions:

Reduce the property tax amount you owe by making a portion of the assessment exempt. These exemptions are available based on physical/mental limitations, income limitations, and service status (veterans, volunteer firefighters, and ambulance workers).

Note: property tax exemptions must be filed on or before January 2nd, 2023 for the 2023/2024 programs.

STAR Program

This school tax relief (STAR) program offers property tax exemptions to eligible homeowners in New York State.

There are two ways to be eligible for this tax exemption and to receive checks from New York State to help with property tax amounts.

Basic STAR Program: This program mails checks annually to help pay for school taxes for applicants who meet the criteria. To be eligible for this program, your primary residence’s household income (calculated using the homeowner’s and homeowner’s spouse’s incomes) must not exceed $500,000.

Enhanced STAR Program: available to senior citizens who qualify for and meet certain income requirements.

Veterans’ Exemptions

Qualifying veterans have access to property tax exemptions, including taxes from counties, towns, and school districts.

Senior Citizens’ Exemption

While special district taxes cannot be reduced, qualifying senior citizens can receive property tax exemptions ranging from 5% to 50% of Nassau County’s county, town, and school district taxes.

Limited Income/Disabilities Exemption

Homeowners with substantial imitations are eligible for up to a 50% property tax exemption.

First Responders’ Exemption

After five years of service, volunteer firefighters and ambulance workers are eligible for a 10% property tax exemption in Nassau County.

How to Make a Tax Payment

During tax season, the Receiver of Taxes is responsible for collecting each municipality’s annual property taxes. After the collection window closes, roughly two weeks after the tax deadline, delinquent taxes must be paid through the Nassau County Treasurer’s Office.

Checks can be mailed to

Nassau County Treasurer

1 West Street

Mineola, NY 11501

If you need assistance making a payment or navigating the treasurer’s website, you can call 516.571.2090 x 13715 for assistance Monday – Friday from 9 am – 4:30 pm.

Individual Municipality Tax Payment Instructions

Long Beach Instructions

Address: City of Long Beach Tax Department, City Hall

1 West Chester Street, Room 300

Phone: 516.431.1008

Head to the City of Long Beach Online Portal to make property tax payments.

Tax Due Dates:

- First half city tax: July 1 through July 31

- Second half general tax: July 1 through Aug. 10

- First half school tax: Oct. 1 through Nov. 10

- Second half city tax: Jan. 1 through Jan. 31

- First half general tax: Jan. 1 through Feb. 10

- Second half school tax: Apr. 1 through May 10

Hempstead Instructions

Address: 200 N. franklin Street, First Floor

Hempstead, NY 11550

Phone: 516.538.1500

Head to the City of Hempstead Online Portal to make property tax payments.

Tax Due Dates:

- First half school tax: Oct. 1 through Nov. 10

- First half general tax: Jan. 1 through Feb. 10

- Second half school tax: Apr. 1 through May 10

- Second half general tax: July 1 through Aug. 10

Glen Cove Instructions

Address: City of Glen Cove, 9 Glen Street

Glen Cove, NY 11542

Phone: 516.676.2000

Head to the City of Glen Cove Online Portal to make property tax payments.

Tax Due Dates:

- First half city tax: Dec. 1 through Jan 10

- First half county tax: Jan. 1 through Feb. 10

- Second half school tax: Feb. 1 through March 1

- Second half city tax: June 1 through July 10

- Second half county tax: July 1 through Aug. 10

- First half school tax: Aug. 1 through Sept. 1

North Hempstead Instructions

North Hempstead, NY Tax Department:

Address: North Hempstead Town Hall, 220 Plandome Road,

Manhasset, NY 11030

Phone: 516.627.4204

Head to the Town of North Hempstead Online Portal to make property tax payments.

Tax Due Dates:

First half school tax: Oct. 1 through Nov. 10

First half general tax: Jan. 1 through Feb. 10

Second half school tax: Apr. 1 through May 10

Second half general tax: July 1 through Aug. 10

Oyster Bay Instructions

Address: Town Hall, 54 Audrey Ave,

Oyster Bay, NY 11771

Phone: 516.624.6400

Head to the City Oystery Bay Online Portal to make property tax payments.

Tax Due Dates:

- First half general tax: Jan. 1 through Feb. 10

- Second half general tax: July 1 through Aug. 10

- First half school tax: Oct. 1 through Nov. 10

- Second half school tax: Apr. 1 through May 10

Contact the Nassau County Department of Assessment:

The Nassau County Department of Assessment has over 423,000 properties to assess and is responsible for:

- Collecting and storing data on residential, commercial, and industrial properties

- Maintaining property records

- Maintaining tax maps

- Handling property tax exemption applications for the STAR programs (both Basic and Enhanced)

If you have any questions about how property tax assessment, property records, or other public inquiries you can contact the Nassau County Department of Assessment Monday – Friday from 8 am – 4:30 pm at

240 Old Country Road, 4th Floor

- 516.571.1500

Ready to File a Tax Grievance and Save Money?

While property taxes in Nassau County are some of the highest in the country, Heller Tax Grievance has a strong history of helping reduce these prices to their lowest, legally allowed rate.

For a commitment-free look at your potential savings, call one of our experts at 516.342.4849 or go online for a free quote. Our application process is simple, and we only get paid if you see a reduction in your property tax rate.

Start your grievance process today!

Our expert staff, coupled with our completely virtual process, means finding out what you can save on taxes is as easy as going online or giving us a call.

If you’re interested in taking advantage of our services, don’t miss the appeals window. This process must begin before your new property tax amount is billed.

The next deadline for Nassau County property tax appeals is March 1st, 2024.

FAQs:

How Much Is Property Tax in Nassau County, and When Are Taxes Due?

A brief breakdown of property tax rates and due dates is available above, but you should always check with your local municipality for the most up-to-date and comprehensive list of taxes and deadlines.

How Do I Pay My Tax Bill?

For most municipalities, you can pay your taxes online during the payment window. However, once the deadline has passed, you may need to pay your tax bill directly with the Nassau County Treasurer. More information on this process is provided above.

Is It Easy to Begin the Tax Grievance Process?

Yes! When working with Heller & Consultants Tax Grievance, the process is made easy. You fill out our online form or give us a call, and we handle the rest. Our hassle-free process is completely virtual, which means no one shows up at your home! Plus, we only get paid if you do, which means you have nothing to lose by giving us a call.

Heller & Consultants Tax Grievance can help you lower your property taxes. Contact us today for a free quote and start saving money