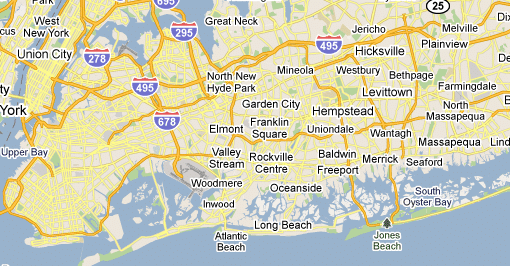

Nassau County Tax Grievance 2024

Tax Grievance in Nassau County, NY has been getting a ton of press lately. Nassau County is one of only 5 counties in the state that are categorized as a “Special Assessment Unit” as defined by New York State. This affords Nassau County certain freedoms that other municipalities do not enjoy, primarily the ability to deal with most tax grievances at their Assessment Review Committee level, better known as ARC.

ARC’s responsibility is to review the valuation set by the Nassau County Department of Assessment and to reduce the assessment if the valuation is excessive. These corrections have resulted in substantial savings to Nassau County Residents, at least the homeowner’s that file a grievance. And therein lies the problem, if you are a Nassau County homeowner who does not file a property tax grievance each and every year, you are subsidizing the residents that do. But let’s look at this even further, tax rates throughout the county are rising faster than global warming. So by not filing a property tax grievance, you are getting a double hit!

“If you are a Nassau County homeowner who does not file a property tax grievance each and every year, you are subsidizing the residents that do”

Bottom Line:

Nassau County residents should file a tax grievance each and every year; otherwise, you are paying too much in property taxes. Since your property tax bill is calculated by multiplying your property assessment by your local tax rate by not filing you are paying, in some cases, double what your neighbor is. Nassau Counties’ property tax grievance deadline is March 3, 2025.