Nassau County Tax Grievance 2024

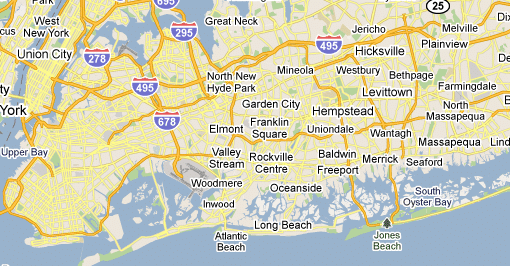

Tax Grievance in Nassau County, NY has been getting a ton of press lately. Nassau County is one of only 5 counties in the state that are categorized as a “Special Assessment Unit” as defined by New York State. This affords Nassau County certain freedoms that other municipalities do not enjoy, primarily the ability to […]

Nassau County Tax Grievance 2024 Read More »