A 2014 Property Tax Grievance Guide-Why This Is The Year!

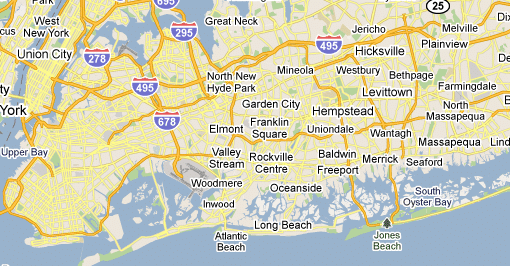

Suffolk County’s real estate market is still recovering which should make most every Suffolk homeowner’s property values decline further this year. The one silver lining in that dark cloud- you might have a great shot at lowering your property taxes. If you think you’ve been over assessed, you have a right to protest the assessment […]

A 2014 Property Tax Grievance Guide-Why This Is The Year! Read More »