Don’t Let High Property Taxes Drain Your Wallet

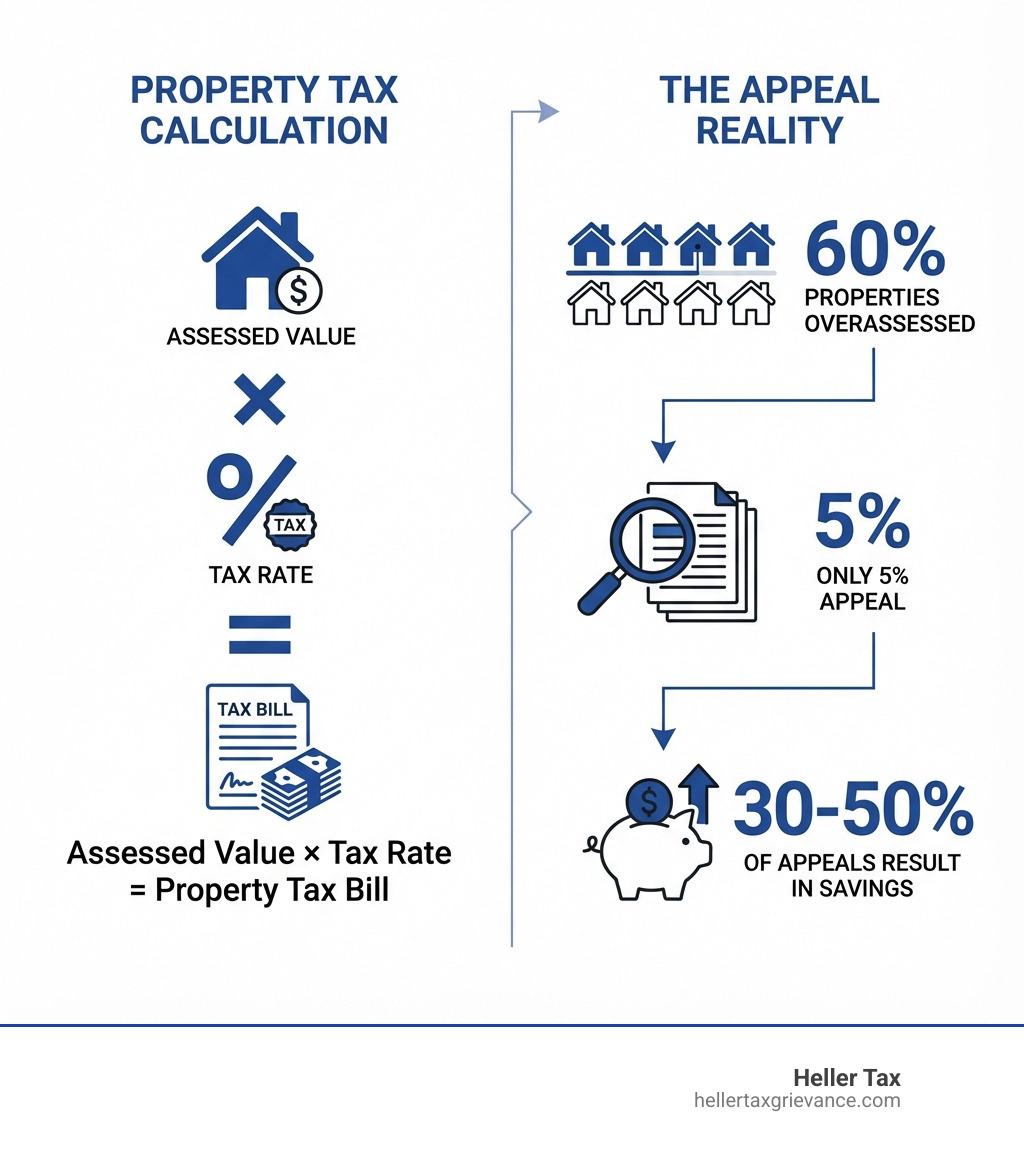

How to lower your property taxes is a question every homeowner should ask. With up to 60% of U.S. properties overassessed, you could be paying more than your fair share. Yet, fewer than 5% of homeowners ever challenge their assessment. Here’s what you need to know to start saving:

Quick Steps to Lower Your Property Taxes:

- Review your assessment notice for errors in square footage, room count, or property features.

- Gather evidence including comparable home sales, photos, and repair estimates.

- File an appeal with your local Assessment Review Board during the filing window (typically January-March).

- Apply for exemptions if you qualify as a senior, veteran, or person with a disability.

- Consider professional help if your case is complex or your property value is high.

Between 30% and 50% of homeowners who appeal win a reduction. Successful appeals can save hundreds to thousands of dollars annually, with savings that continue year after year.

The problem is that most assessments use computerized mass appraisals, not individual inspections, making errors common. A clerical mistake could mean your home is assessed for $50,000 more than your neighbor’s identical one. Assessors might also miss negative factors like proximity to a highway or property damage.

I’m Adam Heller, founder of Heller Tax Grievance. For nearly two decades, I’ve helped Long Island homeowners find *how to lower your property taxes through successful appeals.* Since 2006, my team has helped over 50,000 clients save millions, achieving record-breaking reductions of $73,000 in Nassau County and $17,000 in Suffolk County.

The good news is you have more control over your tax bill than you think. Understanding the process, whether you DIY your appeal or work with a professional, is the first step to paying only what you owe.

Understanding Your Property Tax Bill and Assessment

Property taxes may seem unavoidable, but they aren’t set in stone. The journey to lower your property taxes starts with understanding how they’re calculated.

Your property tax bill is a product of two components: your property’s assessed value and the local tax rate (or millage rate). The formula is: Assessed Value x Tax Rate = Property Tax Bill.

The assessed value is determined by your local assessment body—for Long Islanders, that’s the Nassau County Department of Assessment or Suffolk County’s town assessors. The tax rate is set by your municipality and school districts to fund public services.

This is crucial because while you can’t change the tax rate, you can challenge an incorrect assessed value. For a deeper dive into this foundational concept, we recommend reading our guide on How Property is Assessed & Tax Grievance Works.

How Property Taxes Are Calculated

Property taxes are the lifeblood of local communities, funding schools, police and fire departments, road maintenance, and other essential public services on Long Island.

The calculation is simple: Assessed Value x Combined Tax Rates = Tax Bill. The key is the “assessed value,” which isn’t the same as market value (what your home could sell for). In New York, properties are assessed at a uniform percentage of market value. If your assessed value is too high compared to its market value or similar homes, your tax bill is inflated.

You can’t change how much the town needs to run its services, but you can argue that your slice of the pie is too big. For a comprehensive overview, check out our article, What is Property Tax?.

What is a Property Assessment?

A property assessment is the local government’s valuation of your home for tax purposes. In Nassau County, the Department of Assessment handles this; in Suffolk, it’s the town assessors. They value every property but don’t visit each home annually, relying instead on data.

Assessments are cyclical, with some areas having annual assessments and others having reappraisals every few years. Assessors consider a range of factors to determine your property’s value, including:

- Location: Proximity to schools, transportation, and other amenities.

- Lot Size and Dimensions: The size and usability of your land.

- Living Area (Square Footage): The total heated and cooled space.

- Age of the Structure: How old your home is, adjusted for major renovations.

- Quality of Construction: The materials and craftsmanship used.

- Features: Number of bedrooms and bathrooms, garage, pool, decks, etc.

These factors are fed into mass appraisal systems, which are efficient but prone to errors. To understand how this value is determined, see our Guide to Understanding Assessed Value.

The Step-by-Step Guide on How to Lower Your Property Taxes

The most effective way to lower your property taxes is through a property tax appeal, or tax grievance. This process ensures your assessment is fair and accurate.

The grievance process has strict deadlines. A successful appeal can significantly reduce your annual tax bill by lowering your assessed value. Even if there’s no change, your taxes won’t increase for filing, making it a no-risk situation.

The deadline to file in Nassau County is typically March 1st, and in Suffolk County, it’s usually May 31st (always confirm with your township). Missing the deadline means waiting another year to appeal. For a full breakdown, our article on The Tax Grievance Process and How It Works is an excellent resource.

Step 1: Scrutinize Your Assessment Notice

Your annual property tax assessment notice is more than a bill—it’s a key to potential savings. It contains the official record of your property’s characteristics and assessed value.

Carefully review your property tax card or assessment notice for common factual errors, such as:

- Incorrect Square Footage: Is the living area listed accurately?

- Wrong Number of Rooms: Does it list four bedrooms when you only have three?

- Inaccurate Features: Does it list a two-car garage when you only have one, or a finished basement that’s actually unfinished?

Even minor errors can inflate your assessment. Spotting these discrepancies provides the easiest grounds for a reduction. For more guidance, see our article on Appealing Your Property Tax Assessment.

Step 2: Gather Your Evidence and Build Your Case

After reviewing your notice, gather evidence to build a compelling case that your assessed value is too high. Concrete evidence strengthens your appeal.

Here’s what you should look for:

- Comparable Properties (Comps): This is the most powerful evidence. Find recent sales data for homes very similar to yours that sold for less than your assessed value.

- Photos of Property Condition: Document any deferred maintenance, visible damage, or outdated features that negatively impact its value.

- Repair Estimates: Estimates from contractors for significant repairs (e.g., a new roof, foundation work) can demonstrate a reduced market value.

- Independent Appraisal: A professional appraisal can provide a strong, unbiased valuation, which is especially useful for complex properties.

- Other Supporting Documents: Blueprints, deed records, or other official documents that contradict the assessor’s data.

The goal is to prove your assessed value is higher than its true market value or the assessments of comparable properties. Our Complete Guide for Property Tax Grievances offers more details.

Step 3: File Your Appeal

With your evidence ready, formally file your appeal. The process in Nassau and Suffolk counties involves an initial review and possibly a formal hearing.

In Nassau County, file with the Assessment Review Commission (ARC). In Suffolk County, file with your town’s Board of Assessment Review (BAR). These bodies review your claim.

You must complete specific filing forms from your local assessment department. These forms ask for your property details, the challenged assessed value, your proposed correct value, and the reasons for your appeal. You’ll need the specific form for Nassau or Suffolk County.

After filing, you may have an informal review with an assessor. If no agreement is reached, the case proceeds to a formal hearing before the ARC or BAR, where you’ll present your evidence for a final decision.

Property tax appeals have a good success rate. Between 30% and 50% of homeowners who file an appeal win some kind of reduction. Thorough preparation significantly increases your chances of success.

Building a Winning Case: Evidence and Common Errors

Properties are often over-assessed due to the limitations of mass appraisals. Assessors use computer models to value thousands of properties efficiently, but this approach can miss individual home nuances, leading to errors.

For instance, a computer model won’t account for a busy road or an outdated kitchen—factors that impact market value but are often overlooked in mass assessments.

Your active participation is vital. Understanding these pitfalls and arming yourself with the right evidence is one of The Top 5 Secrets You Must Know to Successfully Lower Your Property Taxes.

How to find and use comparable properties to lower your property taxes

Finding good comparable properties (“comps”) is the cornerstone of a successful appeal. The goal is to show that similar, nearby homes have recently sold for less than your property’s assessed value.

Here’s what makes a good comp:

- Proximity is Key: Look for homes sold within the last year, ideally within a half-mile radius.

- Similar Size: Aim for properties with a living area within 10-15% of your home’s square footage.

- Similar Age: Properties built around the same time as yours are best.

- Similar Condition: A comp in pristine condition isn’t a fair comparison for a home that needs work. Use photos to document differences.

- Similar Features: Look for a comparable number of bedrooms, bathrooms, and garage spaces.

Find sales data through public records, online real estate sites (verify the data), or by asking a real estate agent for a comparative market analysis (CMA). When comparing, you must account for differences. For example, if a comp has a two-car garage and your home doesn’t, you would argue for a downward adjustment to your value.

Identifying Common Assessment Errors

Besides finding comps, identifying specific errors in your assessment can bolster your case. Assessors often make mistakes when dealing with thousands of properties.

Common assessment errors include:

- Clerical Mistakes: A misspelled street name or a transposed number in the square footage.

- Outdated Property Data: Records might not reflect a removed deck or a fire that damaged your home.

- Ignoring Negative Factors: Mass appraisals often don’t account for negative influences like:

- Proximity to Highways or Commercial Zones: Noise and traffic can decrease a home’s value.

- Undesirable Locations: Being next to a gas station or power lines.

- Poor Soil Conditions or Drainage Issues: Problems that impact the property’s usability.

- Overlooking Property Damage or Deterioration: The assessment may not reflect significant wear and tear, a bad roof, or an outdated electrical system.

Identifying these errors and providing documentation (photos, repair estimates) is a powerful way to show the assessor that their valuation doesn’t match your home’s reality. We emphasize Why It’s Important to File a Property Tax Grievance: A Guide to Saving Your Hard-Earned Dollars.

Beyond the Appeal: Exemptions and Relief Programs

Appealing your assessment isn’t the only way to lower your property taxes. Many homeowners overlook valuable exemptions and relief programs. It’s crucial to understand the difference:

- Tax Appeal: Challenges the assessed value of your property, arguing it’s too high.

- Tax Exemption: Reduces the taxable portion of your property’s value based on your personal status (e.g., age, veteran status) or property use.

An appeal argues your home’s value is too high. An exemption provides a discount based on your personal status or property use.

New York State and Long Island offer various property tax exemptions. Always verify specific eligibility for Nassau and Suffolk counties, but the NYC Property Tax Benefits – DOF page provides a good general overview.

Here’s a quick comparison:

| Feature | Tax Appeal | Tax Exemption |

|---|---|---|

| Purpose | Challenges your property’s assessed value | Reduces the taxable portion of your property’s value |

| Eligibility | Based on evidence your property is over-assessed | Based on personal status (age, income, veteran, disability) or property use |

| Action | File a grievance with assessment review body | Apply to the assessor’s office or relevant department |

| Outcome | Lower assessed value, leading to a lower tax bill | Lower taxable value, leading to a lower tax bill |

| Frequency | Can be filed annually | Typically applied once, may require periodic renewal |

| Example | Arguing your home is worth less than assessed based on comps | Homestead Exemption for primary residence, Senior Citizen Exemption |

The Homestead Exemption

The Homestead Exemption is one of the most valuable exemptions for homeowners. It reduces a portion of your home’s assessed value, lowering your tax bill for your owner-occupied primary residence.

To qualify in New York, the property must be your primary residence. The application involves submitting a form to your local assessor’s office. This exemption is not granted automatically, so if you’ve recently purchased your primary residence, be sure to apply.

Understanding exemptions is part of a broader strategy to minimize your tax obligations. We also have resources on Claiming a Property Tax Deduction on Your Federal Tax Filing.

How to lower your property taxes with special programs

Beyond the Homestead Exemption, New York and Long Island offer special programs for specific groups of homeowners. Explore these if you meet the criteria:

- Senior Citizens Exemption: For seniors (typically 65+) who meet certain income requirements.

- Veterans Exemption: For eligible veterans and sometimes their surviving spouses, based on service and disability status.

- Persons with Disabilities Exemption: For homeowners with disabilities who meet income guidelines.

- Agricultural Properties: For properties used for agricultural purposes.

Each program has specific qualification criteria and an application process. Contact your local assessment department to inquire about all available programs to ensure you’re not missing out on savings. These exemptions are a proactive way to lower your property taxes without a formal grievance. For more general advice, see our Tips for Lowering Your Property Tax Bill.

Frequently Asked Questions about Lowering Property Taxes

Here are some of the most common questions we hear from homeowners:

Can I appeal my property taxes without professional help?

Yes, you can handle the appeal process yourself. Local assessment offices provide forms and instructions, making it a viable option for straightforward cases with clear errors or strong comparable sales.

However, the process can be time-consuming and complex, especially for:

- Complex Cases: Properties with unique features or unusual sales histories.

- High-Value Properties: With more money on the line, a professional can often achieve a greater reduction.

- Time Constraints: Researching comps, filling out forms, and attending hearings is a significant burden for busy homeowners.

A firm like Heller Tax Grievance specializes in navigating Nassau and Suffolk County appeals. Our “You Don’t Pay Unless You Save” guarantee means there’s no upfront fee or risk. We only get paid a percentage of your savings, making professional help accessible and risk-free. While you can go it alone, professional assistance is often the smarter path. For more on this, check out Do I Need to Hire a Tax Grievance Company?.

What are the costs associated with appealing property taxes?

Costs for appealing vary depending on whether you do it yourself or hire a professional.

If you DIY, costs are minimal:

- Filing Fees: Some jurisdictions have a nominal fee to file or to advance an appeal (like a small court filing fee for Small Claims Assessment Review).

- Reproduction Costs: Printing photos, gathering documents, etc.

With professional help, costs typically include:

- Contingency Fees: This is our model at Heller Tax Grievance. We charge a percentage of the tax savings we achieve, and only if we succeed.

- Flat Fees: Some firms might charge a flat fee regardless of the outcome.

- Appraisal Costs: An independent appraisal may be an additional cost if needed to strengthen your case.

- Attorney Costs: For very complex cases involving legal proceedings, attorney fees would apply.

Weigh any costs against the potential savings. A successful appeal can lower your property taxes for years, often making professional help a worthwhile investment.

How do home improvements affect my property taxes?

It’s important to understand the tax implications of home improvements.

Generally, significant structural changes, additions, and remodels will increase your assessed value and property taxes. This includes:

- Adding a new room or extension

- Finishing a basement or attic

- Building a garage, deck, or in-ground pool

- Major renovations that significantly increase living space or quality.

These improvements add to your home’s market value, which assessors must reflect in the valuation. Contact your local assessment department before major projects to understand the potential tax impact.

Failure to report major improvements can lead to penalties if finded later. It’s best to follow the rules. Minor cosmetic changes like painting or landscaping typically don’t trigger a reassessment. For more insights, read our article Why Do Property Taxes Go Up?.

Conclusion

This guide should explain how to lower your property taxes and empower you to take action. As Long Island homeowners, we know high property taxes are a burden, but you don’t have to accept an unfair assessment.

By understanding your bill, checking your assessment for errors, gathering evidence, and filing a timely appeal, you can save money. Also, explore available exemptions, which offer significant savings.

Being proactive is key. Whether you handle the grievance yourself or seek professional help, the goal is to ensure you pay only what you owe.

Heller Tax Grievance is dedicated to helping our Nassau and Suffolk County neighbors achieve fair property taxes. With our “You Don’t Pay Unless You Save” guarantee, you have nothing to lose and potentially thousands to gain.

Don’t pay more than you should for another year. Start your Property Tax Grievance today and let us help you keep your hard-earned money.